Reset Form

Print Form

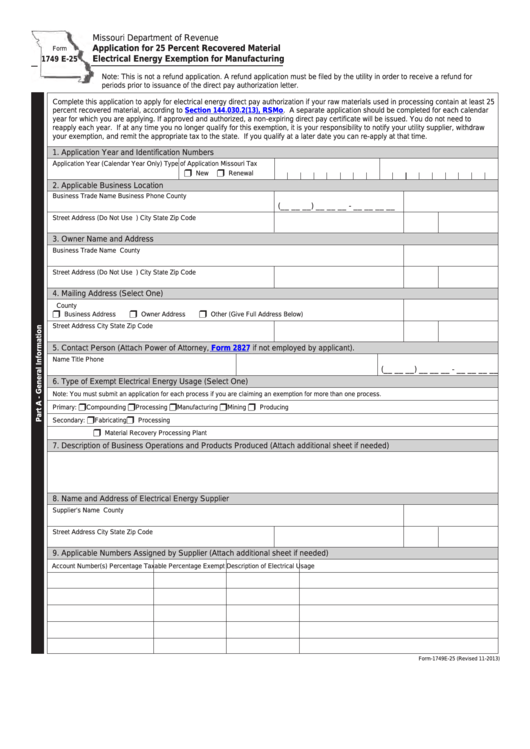

Missouri Department of Revenue

Application for 25 Percent Recovered Material

Form

Electrical Energy Exemption for Manufacturing

1749 E-25

Note: This is not a refund application. A refund application must be filed by the utility in order to receive a refund for

periods prior to issuance of the direct pay authorization letter.

Complete this application to apply for electrical energy direct pay authorization if your raw materials used in processing contain at least 25

percent recovered material, according to

Section 144.030.2(13),

RSMo. A separate application should be completed for each calendar

year for which you are applying. If approved and authorized, a non-expiring direct pay certificate will be issued. You do not need to

reapply each year. If at any time you no longer qualify for this exemption, it is your responsibility to notify your utility supplier, withdraw

your exemption, and remit the appropriate tax to the state. If you qualify at a later date you can re-apply at that time.

1. Application Year and Identification Numbers

A

pplication Year (Calendar Year Only)

Type of Application

Missouri Tax I.D. Number

Federal Employer I.D. Number

r

r

New

Renewal

2. Applicable Business Location

Business Trade Name

Business Phone

County

(__ __ __) __ __ __ - __ __ __ __

Street Address (Do Not Use P.O. Box or Rural Route)

City

State

Zip Code

3. Owner Name and Address

Business Trade Name

County

Street Address (Do Not Use P.O. Box Or Rural Route)

City

State

Zip Code

4. Mailing Address (Select One)

County

r

r

r

Business Address

Owner Address

Other (Give Full Address Below)

Street Address

City

State

Zip Code

5. Contact Person (Attach Power of Attorney,

Form 2827

if not employed by applicant).

Name

Title

Phone

(__ __ __) __ __ __ - __ __ __ __

6. Type of Exempt Electrical Energy Usage (Select One)

Note: You must submit an application for each process if you are claiming an exemption for more than one process.

r

r

r

r

r

Primary:

Compounding

Processing

Manufacturing

Mining

Producing

r

r

Secondary:

Fabricating

Processing

r

Material Recovery Processing Plant

7. Description of Business Operations and Products Produced (Attach additional sheet if needed)

8. Name and Address of Electrical Energy Supplier

Supplier’s Name

County

Street Address

City

State

Zip Code

9. Applicable Numbers Assigned by Supplier (Attach additional sheet if needed)

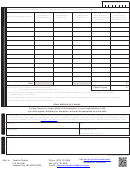

Account Number(s)

Percentage Taxable

Percentage Exempt

Description of Electrical Usage

Form-1749E-25 (Revised 11-2013)

1

1 2

2 3

3