Missouri Tax I.D. Number

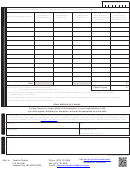

List all raw material suppliers and percentage of recovered material content necessary to qualify for the exemption.

D

A

B

C

E

(B*C) Weight or

Description of

Total Weight or

% of Recovered

% Recovered

Name of Raw Material Supplier

Raw Material

Volume (T1)

Material (2)

Volume of Recovered

Materials in Total

Materials

Raw Materials (3)

Total

%

0

Check Figure: Total of Column D divided by Column B

Check Figure

%

(This number should equal the total for Column E.)

(1) You can use either the weight of the materials or the volume of the materials. In either case, you must use the same unit of measure

(pounds, ounces, feet or inches).

(2) This represents the percent of recovered materials in the raw materials. Your supplier should provide you with this information on form 5021.

(3) Divide amounts in Column D by the total of Column B.

Attach additional list if needed.

If at any time you no longer qualify for this exemption, it is your responsibility to notify

your utility supplier, withdraw your exemption, and remit the appropriate tax to the state.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I declare that I have direct

control, supervision or responsibility for completing this application. Declaration of preparer (other than taxpayer) is based on all information of which he

or she has any knowledge. As provided in

Chapter 143,

RSMo, a penalty of up to $500 shall be imposed on any individual who files a frivolous return.

Signature

Title

Printed Name

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Form-1749E-25 (Revised 11-2013)

Visit

dor.mo.gov/business/sales/

Mail to:

Taxation Division

Phone: (573) 751-2836

for additional information.

P.O. Box 358

Fax: (573) 751-9409

E-mail:

salestaxexemptions@dor.mo.gov

Jefferson City, MO 65105-0358

1

1 2

2 3

3