Form Aud-43 - Agreement To Maintain Records In Accordance With The International Registration Plan (Irp)

ADVERTISEMENT

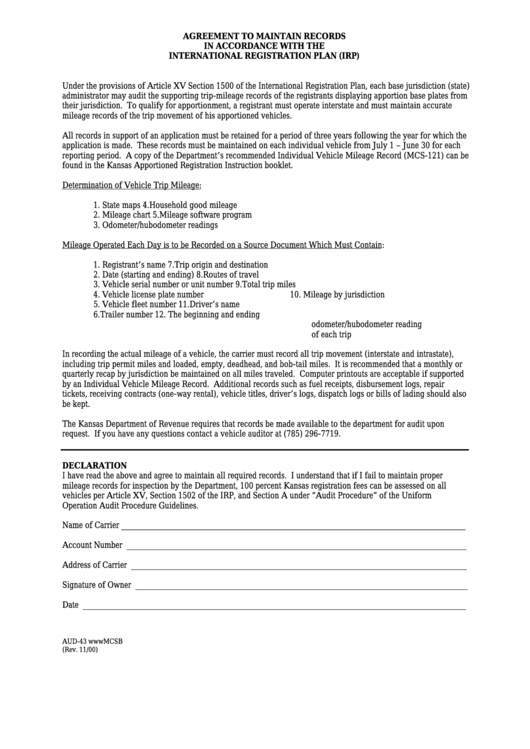

AGREEMENT TO MAINTAIN RECORDS

IN ACCORDANCE WITH THE

INTERNATIONAL REGISTRATION PLAN (IRP)

Under the provisions of Article XV Section 1500 of the International Registration Plan, each base jurisdiction (state)

administrator may audit the supporting trip-mileage records of the registrants displaying apportion base plates from

their jurisdiction. To qualify for apportionment, a registrant must operate interstate and must maintain accurate

mileage records of the trip movement of his apportioned vehicles.

All records in support of an application must be retained for a period of three years following the year for which the

application is made. These records must be maintained on each individual vehicle from July 1 – June 30 for each

reporting period. A copy of the Department’s recommended Individual Vehicle Mileage Record (MCS-121) can be

found in the Kansas Apportioned Registration Instruction booklet.

Determination of Vehicle Trip Mileage:

1. State maps

4. Household good mileage

2. Mileage chart

5. Mileage software program

3. Odometer/hubodometer readings

Mileage Operated Each Day is to be Recorded on a Source Document Which Must Contain:

1. Registrant’s name

7. Trip origin and destination

2. Date (starting and ending)

8. Routes of travel

3. Vehicle serial number or unit number

9. Total trip miles

4. Vehicle license plate number

10. Mileage by jurisdiction

5. Vehicle fleet number

11. Driver’s name

6. Trailer number

12. The beginning and ending

odometer/hubodometer reading

of each trip

In recording the actual mileage of a vehicle, the carrier must record all trip movement (interstate and intrastate),

including trip permit miles and loaded, empty, deadhead, and bob-tail miles. It is recommended that a monthly or

quarterly recap by jurisdiction be maintained on all miles traveled. Computer printouts are acceptable if supported

by an Individual Vehicle Mileage Record. Additional records such as fuel receipts, disbursement logs, repair

tickets, receiving contracts (one-way rental), vehicle titles, driver’s logs, dispatch logs or bills of lading should also

be kept.

The Kansas Department of Revenue requires that records be made available to the department for audit upon

request. If you have any questions contact a vehicle auditor at (785) 296-7719.

DECLARATION

I have read the above and agree to maintain all required records. I understand that if I fail to maintain proper

mileage records for inspection by the Department, 100 percent Kansas registration fees can be assessed on all

vehicles per Article XV, Section 1502 of the IRP, and Section A under “Audit Procedure” of the Uniform

Operation Audit Procedure Guidelines.

Name of Carrier _______________________________________________________________________________

Account Number ______________________________________________________________________________

Address of Carrier _____________________________________________________________________________

Signature of Owner ____________________________________________________________________________

Date ________________________________________________________________________________________

AUD-43 wwwMCSB

(Rev. 11/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1