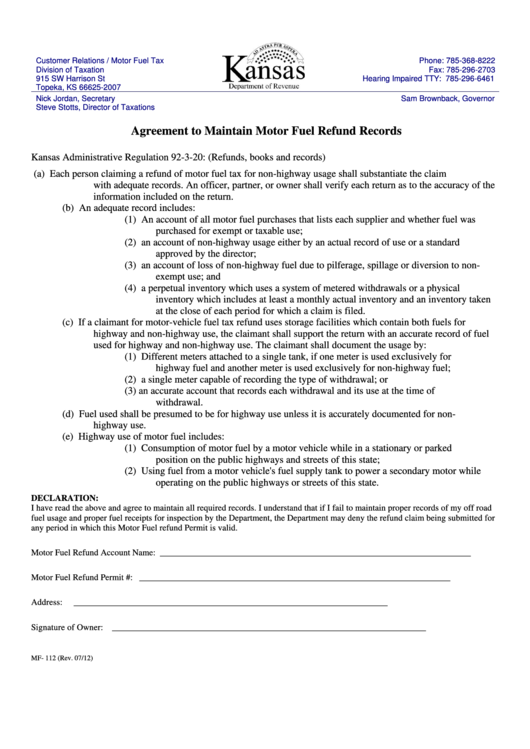

Customer Relations / Motor Fuel Tax

Phone: 785-368-8222

Division of Taxation

Fax: 785-296-2703

915 SW Harrison St

Hearing Impaired TTY: 785-296-6461

Topeka, KS 66625-2007

Nick Jordan, Secretary

Sam Brownback, Governor

Steve Stotts, Director of Taxations

Agreement to Maintain Motor Fuel Refund Records

Kansas Administrative Regulation 92-3-20: (Refunds, books and records)

(a)

Each person claiming a refund of motor fuel tax for non-highway usage shall substantiate the claim

with adequate records. An officer, partner, or owner shall verify each return as to the accuracy of the

information included on the return.

(b)

An adequate record includes:

(1)

An account of all motor fuel purchases that lists each supplier and whether fuel was

purchased for exempt or taxable use;

(2)

an account of non-highway usage either by an actual record of use or a standard

approved by the director;

(3)

an account of loss of non-highway fuel due to pilferage, spillage or diversion to non-

exempt use; and

(4)

a perpetual inventory which uses a system of metered withdrawals or a physical

inventory which includes at least a monthly actual inventory and an inventory taken

at the close of each period for which a claim is filed.

(c)

If a claimant for motor-vehicle fuel tax refund uses storage facilities which contain both fuels for

highway and non-highway use, the claimant shall support the return with an accurate record of fuel

used for highway and non-highway use. The claimant shall document the usage by:

(1)

Different meters attached to a single tank, if one meter is used exclusively for

highway fuel and another meter is used exclusively for non-highway fuel;

(2)

a single meter capable of recording the type of withdrawal; or

(3)

an accurate account that records each withdrawal and its use at the time of

withdrawal.

(d)

Fuel used shall be presumed to be for highway use unless it is accurately documented for non-

highway use.

(e)

Highway use of motor fuel includes:

(1)

Consumption of motor fuel by a motor vehicle while in a stationary or parked

position on the public highways and streets of this state;

(2)

Using fuel from a motor vehicle's fuel supply tank to power a secondary motor while

operating on the public highways or streets of this state.

DECLARATION:

I have read the above and agree to maintain all required records. I understand that if I fail to maintain proper records of my off road

fuel usage and proper fuel receipts for inspection by the Department, the Department may deny the refund claim being submitted for

any period in which this Motor Fuel refund Permit is valid.

Motor Fuel Refund Account Name:

_______________________________________________________________________

Motor Fuel Refund Permit #:

_______________________________________________________________________

Address:

_______________________________________________________________________

Signature of Owner:

_______________________________________________________________________

MF- 112 (Rev. 07/12)

1

1