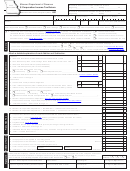

3. Allocation per attached balance sheet or schedule

(A)

Missouri

(B)

Everywhere

(see instructions)

.

.

00

00

3a. Accounts receivable (net of allowance for bad debt) ........... 3a

3a

.

.

3b. Inventories (net, book value) ............................................... 3b

00

3b

00

.

.

3c. Land and fixed assets (net of accumulated depreciation) ... 3c

3c

00

00

.

.

3d. Total allocated assets (add Lines 3a, 3b, and 3c) ............... 3d

00

00

3d

4. Missouri percentage for apportionment (Line 3d, Column A divided by Column B).

.

4

Extend the apportionment percentage to four digits to the right of the decimal point ............

%

.

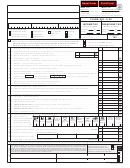

00

5. Assets apportioned to Missouri (Line 2c times Line 4) .................................................................... 5

6. Tax Basis:

.

6a. Corporations having all assets within Missouri (Line 2c or Line 1, whichever is greater)........... 6a

00

6b. Corporations having assets both within Missouri and without Missouri (Line 5, or the product

.

00

of Line 1 times Line 4, whichever is greater) .............................................................................. 6b

If Line 6a or Line 6b is $10,000,000 or less, stop here and check Box A on

Form MO-1120

or

Form

MO-1120S.

Box A on

7. Tax Computation

.

7a. Tax -- 1/150th of 1% (.000067 of Line 6a or Line 6b) ..................................................... 7a

00

7b. Short period Returns Prorated Tax Due (see instructions)

Line 7a x

(insert number of whole months in short period)

.

00

...................... 7b

12

.

7c. Computed current year tax (enter the amount from Line 7a or Line 7b, whichever applies) ..... 7c

00

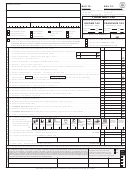

7d. Base Year Franchise Tax. Enter the franchise tax from the return for the taxable year ending on

or before December 31, 2010, (before the tax is prorated, if the return is for a short period).

If the corporation had no franchise tax filing requirement for the taxable year ending on or

before December 31, 2010, the base year is the franchise tax liability for the corporation’s

first full taxable year on or after the taxable year ending December 31, 2010. If this is the first

.

year the corporation had a filing requirement, skip this line and go to Line 7e. ......................... 7d

00

7e. Tax due. Enter the smaller of Line 7c or Line 7d here and on Form MO-1120, Line 16 or

Form MO-1120S, Line 15. If no amount was entered on Line 7d, enter the amount

.

00

from Line 7c ................................................................................................................................ 7e

Form MO-FT (Revised 12-2014)

Attach to Form MO-1120 or Form MO-1120S and mail to the appropriate address as shown on page 1 of the MO-1120 or MO-1120S.

Visit

Taxation Division

Phone: (573) 751-4541

for additional information.

P.O. Box 3365

Fax: (573) 522-1721

E-mail:

franchise@dor.mo.gov

Jefferson City, MO 65105-3365

*15103020001*

15103020001

1

1 2

2 3

3 4

4 5

5