Reset Form

Print Form

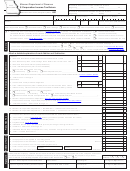

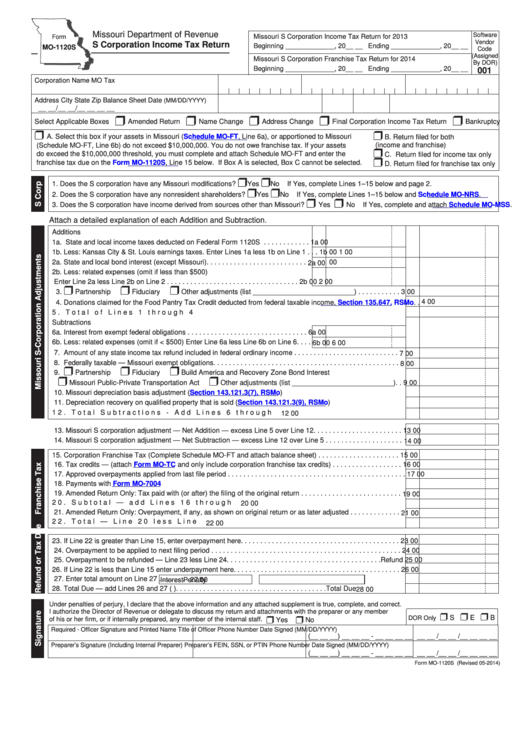

Missouri Department of Revenue

Software

Missouri S Corporation Income Tax Return for 2013

Form

Vendor

S Corporation Income Tax Return

Beginning _____________, 20__ __ Ending _____________, 20__ __

MO‑1120S

Code

(Assigned

Missouri S Corporation Franchise Tax Return for 2014

By DOR)

Beginning _____________, 20__ __ Ending _____________, 20__ __

001

Corporation Name

MO Tax I.D. Number

Charter Number

Federal I.D. Number

Address

City

State

Zip

Balance Sheet Date

(MM/DD/YYYY)

__ __/__ __/__ __ __ __

r

r

r

r

r

Select Applicable Boxes

Amended Return

Name Change

Address Change

Final Corporation Income Tax Return

Bankruptcy

r

r

A. Select this box if your assets in Missouri

(Schedule

MO‑FT, Line 6a), or apportioned to Missouri

B. Return filed for both

(income and franchise)

(Schedule MO-FT, Line 6b) do not exceed $10,000,000. You do not owe franchise tax. If your assets

r

do exceed the $10,000,000 threshold, you must complete and attach Schedule MO-FT and enter the

C. Return filed for income tax only

r

franchise tax due on the

Form

MO‑1120S, Line 15 below. If Box A is selected, Box C cannot be selected.

D. Return filed for franchise tax only

r

r

1. Does the S corporation have any Missouri modifications?

Yes

No

If Yes, complete Lines 1–15 below and page 2.

r

r

2. Does the S corporation have any nonresident shareholders?

Yes

No

If Yes, complete Lines 1–15 below and

Schedule

MO‑NRS.

r

r

3. Does the S corporation have income derived from sources other than Missouri?

Yes

No If Yes, complete and attach

Schedule

MO‑MSS.

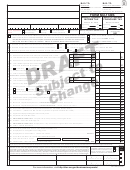

Attach a detailed explanation of each Addition and Subtraction.

Additions

1a. State and local income taxes deducted on Federal Form 1120S . . . . . . . . . . . .

1a

00

1b. Less: Kansas City & St. Louis earnings taxes. Enter Lines 1a less 1b on Line 1 . . .

1b

00

1

00

2a. State and local bond interest (except Missouri) . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2a

00

2b. Less: related expenses (omit if less than $500)

Enter Line 2a less Line 2b on Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b

00

2

00

r

r

r

3.

Partnership

Fiduciary

Other adjustments (list __________________________) . . . . . . . . . . .

3

00

4

00

4. Donations claimed for the Food Pantry Tax Credit deducted from federal taxable income,

Section 135.647,

RSMo. .

5. Total of Lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

Subtractions

6a. Interest from exempt federal obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

00

6b. Less: related expenses (omit if < $500) Enter Line 6a less Line 6b on Line 6 . . . .

6b

00

6

00

7. Amount of any state income tax refund included in federal ordinary income . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Federally taxable — Missouri exempt obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

r

r

r

9.

Partnership

Fiduciary

Build America and Recovery Zone Bond Interest

r

r

Missouri Public-Private Transportation Act

Other adjustments (list __________________________). .

9

00

10. Missouri depreciation basis adjustment

(Section 143.121.3(7),

RSMo). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11. Depreciation recovery on qualified property that is sold

(Section 143.121.3(9),

RSMo) . . . . . . . . . . . . . . . . . .

11

00

12. Total Subtractions - Add Lines 6 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13. Missouri S corporation adjustment — Net Addition — excess Line 5 over Line 12. . . . . . . . . . . . . . . . . . . . . . .

13

00

14. Missouri S corporation adjustment — Net Subtraction — excess Line 12 over Line 5 . . . . . . . . . . . . . . . . . . . .

14

00

15. Corporation Franchise Tax (Complete Schedule MO-FT and attach balance sheet) . . . . . . . . . . . . . . . . . . . . .

15

00

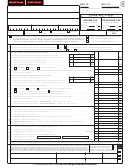

16. Tax credits — (attach

Form MO‑TC

and only include corporation franchise tax credits) . . . . . . . . . . . . . . . . . .

16

00

17. Approved overpayments applied from last file period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

18. Payments with

Form MO‑7004

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19. Amended Return Only: Tax paid with (or after) the filing of the original return . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20. Subtotal — add Lines 16 through 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

21. Amended Return Only: Overpayment, if any, as shown on original return or as later adjusted . . . . . . . . . . . . .

21

00

22. Total — Line 20 less Line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23. If Line 22 is greater than Line 15, enter overpayment here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

24. Overpayment to be applied to next filing period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25. Overpayment to be refunded — Line 23 less Line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Refund 25

00

26. If Line 22 is less than Line 15 enter underpayment here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27. Enter total amount on Line 27

. . . . . . . .

27

00

Interest

Penalty

28. Total Due — add Lines 26 and 27 (U.S. funds only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total Due 28

00

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any member

r

r

r

S

E

B

r

r

DOR Only

of his or her firm, or if internally prepared, any member of the internal staff.

Yes

No

Required - Officer Signature and Printed Name

Title of Officer

Phone Number

Date Signed (MM/DD/YYYY)

(__ __ __) __ __ __ - __ __ __ __

__ __ /__ __ /__ __ __ __

Preparer’s Signature (Including Internal Preparer)

Preparer’s FEIN, SSN, or PTIN

Phone Number

Date Signed (MM/DD/YYYY)

(__ __ __) __ __ __ - __ __ __ __

__ __ /__ __ /__ __ __ __

Form MO-1120S (Revised 05-2014)

1

1 2

2 3

3