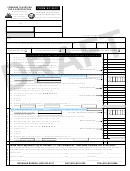

Form Dr-904 Draft - Pollutants Tax Return - 2018 Page 3

ADVERTISEMENT

00002

DR-904

R. 01/15

Page 3

(1) Coastal

(4) Water Quality on

(2) Water Quality

(3) Inland Protection

Protection

Perchloroethylene

Schedule A - Solvents

1.

Gallons sold/removed from storage: ......................

1.

2.

Tax-paid gallons and gallons not subject to tax: .....

2.

3.

Export allowance: ...................................................

3.

4.

Net taxable gallons: ................................................

4.

0.059

5.00

5.

Rate per gallon: .......................................................

5.

6.

Tax due: ..................................................................

6.

Schedule B - Motor Oil & Other Lubricants

7.

Gallons sold/removed from storage: ......................

7.

8.

Tax-paid gallons and gallons not subject to tax: ....

8.

9.

Export allowance: ...................................................

9.

10. Net taxable gallons: ................................................

10.

0.025

11. Rate per gallon: .......................................................

11.

12. Tax due: ..................................................................

12.

Schedule C - Ammonia

13. Barrels sold/removed from storage: .......................

13.

14. Tax-paid barrels and barrels not subject to tax: ......

14.

15. Export allowance: ...................................................

15.

16. Net taxable barrels: .................................................

16.

0.02

0.02

17. Rate per barrel: .......................................................

17.

18. Tax due: ..................................................................

18.

Schedule D - Gasoline and Gasohol

19. Barrels sold/removed from storage: .......................

19.

20. Barrels not subject to tax: ........................................

20.

21. Export allowance: ...................................................

21.

22. Net taxable barrels: .................................................

22.

0.02

0.05

0.80

23. Rate per barrel: .......................................................

23.

24. Tax due: ..................................................................

24.

Schedule E- Diesel and Other Pollutants

25. Barrels sold/removed from storage: .......................

25.

26. Tax-paid barrels and barrels not subject to tax: ......

26.

27. Export allowance (see Important Notice, Page 1): ...

27.

28. Net taxable barrels: .................................................

28.

0.02

0.05

0.80

29. Rate per barrel: .......................................................

29.

30. Tax due: ..................................................................

30.

(1) Coastal

(4) Water Quality on

(2) Water Quality

(3) Inland Protection

Protection

Perchloroethylene

31. Credits: (see instructions) .......................................

31.

32. Credit for tax-paid petroleum products transferred

to a registered IRS terminal (see instructions). ........

32.

33. Total tax due: Calculate total tax due by

subtracting your credits (Line 31 plus Line 32) from

33.

the tax due (sum of Lines 6, 12, 18, 24, and 30). ....

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6