Form 539 - Election To Defer Tax

ADVERTISEMENT

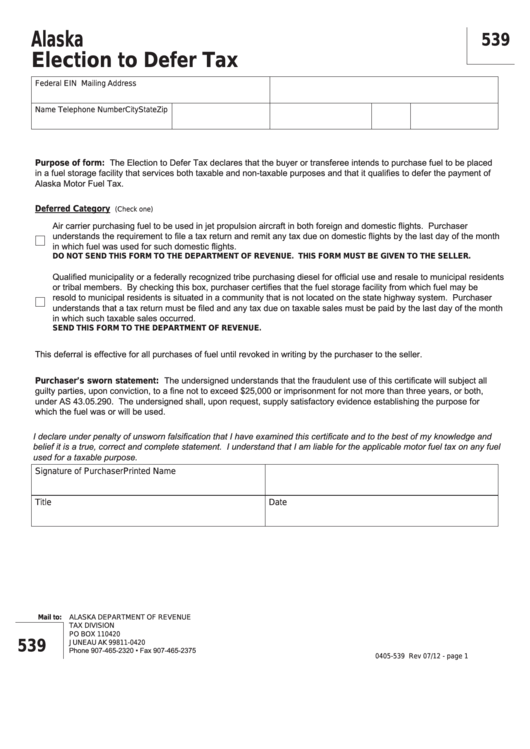

Alaska

539

Election to Defer Tax

Federal EIN

Mailing Address

Name

Telephone Number

City

State

Zip

Purpose of form: The Election to Defer Tax declares that the buyer or transferee intends to purchase fuel to be placed

in a fuel storage facility that services both taxable and non-taxable purposes and that it qualifies to defer the payment of

Alaska Motor Fuel Tax.

Deferred Category

(Check one)

Air carrier purchasing fuel to be used in jet propulsion aircraft in both foreign and domestic flights. Purchaser

understands the requirement to file a tax return and remit any tax due on domestic flights by the last day of the month

in which fuel was used for such domestic flights.

DO NOT SEND THIS FORM TO THE DEPARTMENT OF REVENUE. THIS FORM MUST BE GIVEN TO THE SELLER.

Qualified municipality or a federally recognized tribe purchasing diesel for official use and resale to municipal residents

or tribal members. By checking this box, purchaser certifies that the fuel storage facility from which fuel may be

resold to municipal residents is situated in a community that is not located on the state highway system. Purchaser

understands that a tax return must be filed and any tax due on taxable sales must be paid by the last day of the month

in which such taxable sales occurred.

SEND THIS FORM TO THE DEPARTMENT OF REVENUE.

This deferral is effective for all purchases of fuel until revoked in writing by the purchaser to the seller.

Purchaser’s sworn statement: The undersigned understands that the fraudulent use of this certificate will subject all

guilty parties, upon conviction, to a fine not to exceed $25,000 or imprisonment for not more than three years, or both,

under AS 43.05.290. The undersigned shall, upon request, supply satisfactory evidence establishing the purpose for

which the fuel was or will be used.

I declare under penalty of unsworn falsification that I have examined this certificate and to the best of my knowledge and

belief it is a true, correct and complete statement. I understand that I am liable for the applicable motor fuel tax on any fuel

used for a taxable purpose.

Signature of Purchaser

Printed Name

Title

Date

Mail to:

ALASKA DEPARTMENT OF REVENUE

TAX DIVISION

PO BOX 110420

539

JUNEAU AK 99811-0420

Phone 907-465-2320 • Fax 907-465-2375

0405-539 Rev 07/12 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1