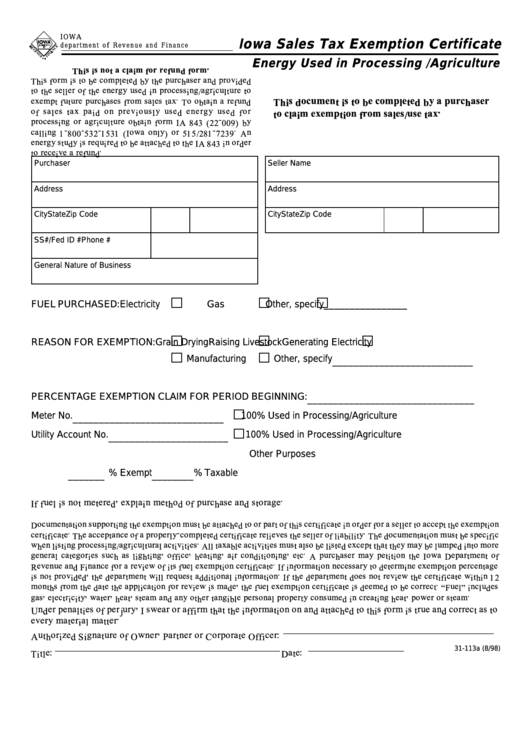

Form 31-113b - Iowa Sales Tax Exemption Certificate - Energy Used In Processing /agriculture

ADVERTISEMENT

I OWA

Iowa Sales Tax Exemption Certificate

d e p a r t m e n t o f R eve n u e a n d F i n a n c e

Energy Used in Processing /Agriculture

Purchaser

Seller Name

Address

Address

City

State

Zip Code

City

State

Zip Code

SS#/Fed ID #

Phone #

General Nature of Business

FUEL PURCHASED:

Electricity

Gas

Other, specify ________________

REASON FOR EXEMPTION:

Grain Drying

Raising Livestock

Generating Electricity

Manufacturing

Other, specify ___________________________

PERCENTAGE EXEMPTION CLAIM FOR PERIOD BEGINNING: ________________________________

Meter No. _____________________________

100% Used in Processing/Agriculture

Utility Account No. _______________________

100% Used in Processing/Agriculture

Other Purposes

_______ % Exempt

________ % Taxable

31-113a (8/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2