Instructions For Form M2 - Minnesota Income Tax For Estates And Trusts (Fiduciary) - 2016 Page 5

ADVERTISEMENT

M2, Lines 10–17

included in your federal taxable income. Do

to check the box for Schedule M1LS and

Line 15c. If you are including an amount

not include, however, any income or gains

include a copy of the schedule when you file

on this line you must include a statement

that are being distributed to the beneficiary.

your return.

indicating which credit(s) are being claimed

as well as any required forms.

Examples of income not subject to Minne-

Schedule M2MT—Alternative Minimum

sota tax include:

Tax. If you had to complete federal Schedule

Include on line 15c only credits that are be-

I, Alternative Minimum Tax, you must com-

ing retained by the fiduciary.

• gains from the sale or other disposi tion of

plete Minnesota Schedule M2MT, Alterna-

real or tangible property outside Minne-

Line 15d. If you are including an amount

tive Minimum Tax for Estates and Trusts.

sota,

on this line you must include a statement

Include the amount from line 17 of Sched-

indicating which credit(s) are being claimed

• income or gains from the operation of a

ule M2MT on line 12 of Form M2. Be sure

as well as any required forms. If you have

farm outside Minnesota,

to check the box for Schedule M2MT and

nonrefundable credits available calculate the

• profit from a trade or business out side

include a copy of the schedule with your

amount to enter on line 15d as follows:

Minnesota (enter the name and location

return.

• If the amount of nonrefundable cred-

of the trade or business under line 7),

Line 13

its available is less than or equal to the

• out-of-state income from partnerships,

Composite Income Tax

amount on line 14 enter the full amount

S corporations and other fiduciaries (en-

Add the composite income tax attributed to

on line 15d,

ter the name and location of the partner-

all electing beneficiaries (the total of lines 27

ship or other fiducia ry under line 7),

• If the amount of nonrefundable credits

from all KF schedules), and enter the result

available is more than the amount on line

• rents and royalties from land, build ings,

on line 13 of Form M2.

14 enter on line 15d the amount of line

machinery or other tangible property

14.

Lines 15a-15d and 15

outside Minnesota (enter the name and

location of the property producing the

Total Payments and Credits

Credit for Taxes Paid to Another State

Line 15a. Enter your total estimated tax and

rents and royalties under line 7), and

You may claim a nonrefundable credit on

extension payments paid for the tax year,

line 15 for taxes paid to another state if you

• interest, dividends, income and gains

including:

were a resident trust or estate and you paid

from stocks, bonds and other securities

2016 income tax (including tax withheld)

for nonresident estates and trusts, unless

• your total 2016 estimated tax payments

to Minnesota and to another state on the

the income was generated by a trade or

made in 2016 and 2017, either paid elec-

same income. For purposes of this credit,

business (S corporations and partner-

tronically or by check,

a Canadian province or territory and the

ships) and was apportioned to Minne-

• the portion of your 2015 refund applied

District of Columbia are considered a state.

sota.

to your 2016 estimated tax, and

The credit cannot exceed the tax shown on

line 10.

Enclose a separate schedule, if needed.

• any 2016 extension payment, paid elec-

tronically or by check, that was made by

Use Schedule M1CR, Credit for Income Tax

Line 10

the due date when filing under an exten-

Paid to Another State, as a worksheet to de-

Minnesota Tax

sion.

termine the credit. When you file Form M2,

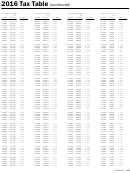

Use the table starting on page 10 to deter-

include the M1CR worksheet or a statement

mine the amount to enter on line 10.

Line 15b. Enter the total of any 2016 Min-

showing how you arrived at the amount.

nesota tax withheld, including:

Line 11

Line 17

• backup with holding on income retained

Tax from S portion of an Electing Small

by the es tate or trust,

Penalty

Business Trust

Penalties are collected as part of the tax and

If you are filing as an Electing Small Busi-

• Minnesota income tax with held in er-

are in addition to any charge for underpay-

ness Trust (ESBT), you must file Schedule

ror (and not repaid) by an em ployer on

ing estimated tax. If you are paying your

M2SB to report all items relating to the S

wages and salaries of a decedent that was

tax after the regular due date, include the

portion of the trust. Enter the tax calcu-

received by the decedent’s estate (enclose

appropriate penalties on line 17. Include a

lated on the M2SB on line 11 of Form M2.

a copy of federal Form W-2, Wage and

statement showing how you arrived at the

Include Schedule M2SB when you file Form

Tax Statement), and

penalty amount.

M2.

• the fiduciary’s share of any Minnesota

Please note: An extension of time to file

income tax withholding from Schedule

Line 12

is not an extension to pay. Therefore, if

KS or KPI not passed through to the ben-

Additional Tax

payment in full is not made by the original

eficiaries.

Schedule M1LS—Tax on a Lump-Sum

due date, an extension of time is invalid and

If you are including withholding on line

Distribution. If you received a lump-sum

both late-filing and late-payment penalties

15b, you must include with your Form M2

distribution from a qualified pension plan,

become applicable.

a copy of the 1099, Schedule KPI, Schedule

profit sharing plan or stock bonus plan and

KS or other documentation showing the

Late Payment. If the tax is not paid by

the 10-year averaging method on federal

amount withheld. If the documentation is

the original due date, a penalty is due of 6

Form 4972 was used, you must complete

percent of the unpaid tax on line 16.

not included, the department will disallow

Minnesota Schedule M1LS, Tax on Lump-

the amount and assess the tax or reduce

Sum Distribution.

your refund.

Include the amount from line 11 of Sched-

ule M1LS on line 12 of Form M2. Be sure

5

Continued

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13