Instructions For Form M2 - Minnesota Income Tax For Estates And Trusts (Fiduciary) - 2017 Page 14

ADVERTISEMENT

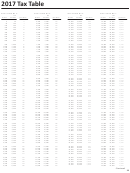

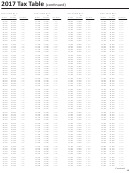

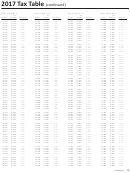

2017 Tax Table

(continued)

If line 9 of Form M2 is:

If line 9 of Form M2 is:

If line 9 of Form M2 is:

If line 9 of Form M2 is:

but

but

but

but

at least

your tax is:

at least

your tax is:

at least

your tax is:

at least

your tax is:

less than

less than

less than

less than

77,900

78,000

5,214

80,900

81,000

5,449

83,900

84,000

5,685

86,900

87,000

5,920

78,000

78,100

5,222

81,000

81,100

5,457

84,000

84,100

5,693

87,000

87,100

5,928

78,100

78,200

5,229

81,100

81,200

5,465

84,100

84,200

5,700

87,100

87,200

5,936

78,200

78,300

5,237

81,200

81,300

5,473

84,200

84,300

5,708

87,200

87,300

5,944

78,300

78,400

5,245

81,300

81,400

84,300

84,400

87,300

87,400

5,481

5,716

5,952

78,400

78,500

5,253

81,400

81,500

5,488

84,400

84,500

5,724

87,400

87,500

5,959

78,500

78,600

5,261

81,500

81,600

5,496

84,500

84,600

5,732

87,500

87,600

5,967

78,600

78,700

5,269

81,600

81,700

5,504

84,600

84,700

5,740

87,600

87,700

5,975

78,700

78,800

5,277

81,700

81,800

84,700

84,800

87,700

87,800

5,512

5,748

5,983

78,800

78,900

5,284

81,800

81,900

5,520

84,800

84,900

5,755

87,800

87,900

5,991

78,900

79,000

5,292

81,900

82,000

5,528

84,900

85,000

5,763

87,900

88,000

5,999

79,000

79,100

5,300

82,000

82,100

5,536

85,000

85,100

5,771

88,000

88,100

6,007

79,100

79,200

5,308

82,100

82,200

85,100

85,200

88,100

88,200

5,543

5,779

6,014

79,200

79,300

5,316

82,200

82,300

5,551

85,200

85,300

5,787

88,200

88,300

6,022

79,300

79,400

5,324

82,300

82,400

5,559

85,300

85,400

5,795

88,300

88,400

6,030

79,400

79,500

5,331

82,400

82,500

5,567

85,400

85,500

5,802

88,400

88,500

6,038

79,500

79,600

5,339

82,500

82,600

85,500

85,600

88,500

88,600

5,575

5,810

6,046

79,600

79,700

5,347

82,600

82,700

5,583

85,600

85,700

5,818

88,600

88,700

6,054

79,700

79,800

5,355

82,700

82,800

5,591

85,700

85,800

5,826

88,700

88,800

6,062

79,800

79,900

5,363

82,800

82,900

5,598

85,800

85,900

5,834

88,800

88,900

6,069

79,900

80,000

5,371

82,900

83,000

85,900

86,000

88,900

89,000

5,606

5,842

6,077

80,000

80,100

5,379

83,000

83,100

5,614

86,000

86,100

5,850

89,000

89,100

6,085

80,100

80,200

5,386

83,100

83,200

5,622

86,100

86,200

5,857

89,100

89,200

6,093

80,200

80,300

5,394

83,200

83,300

5,630

86,200

86,300

5,865

89,200

89,300

6,101

80,300

80,400

5,402

83,300

83,400

5,638

86,300

86,400

5,873

89,300

89,400

6,109

80,400

80,500

5,410

83,400

83,500

5,645

86,400

86,500

5,881

89,400

89,500

6,116

80,500

80,600

5,418

83,500

83,600

5,653

86,500

86,600

5,889

89,500

89,600

6,124

80,600

80,700

5,426

83,600

83,700

5,661

86,600

86,700

5,897

89,600

89,700

6,132

80,700

80,800

5,434

83,700

83,800

5,669

86,700

86,800

5,905

89,700

89,800

6,140

80,800

80,900

5,441

83,800

83,900

86,800

86,900

89,800

89,900

5,677

5,912

6,148

89,900

90,000

6,156

90,000 & over

Enter on line 10

If line 9 of Form M2

is:

of your Form M2:

of the

but not

amount over—

over—

over—

$0

$18,560

$0.00

5.35%

$0

18,560

73,730

992.96 + 7.05%

18,560

73,730

130,760

4,882.45 + 7.85%

73,730

130,760

9,359.31 + 9.85%

130,760

Common Problems Using Software Packages

If you use tax preparation software, be careful to buy packages acceptable to the Department of Revenue. Forms produced by the software

must meet requirements and be approved before being sold or provided to consumers.

If you are considering any company’s tax preparation software, ask to see the vendor’s approval letter for the forms you will be using. Keep

in mind that we usually won’t know if they are approved until late January. It is also important to test the software before filing forms pre-

pared with it. We do not, however, approve the operation or accuracy of any software.

Below are common problems found on fiduciary returns submitted using software packages:

• Verify that the program uses updated tax tables. Tax tables are required to be updated every year for inflation. Be sure that the amount on

line 10 of your Form M2 is the same amount shown in the tax tables.

— Fiscal year filers must use the table based on the beginning year of the return.

— If you are an Electing Small Business Trust (ESBT), verify that the software package uses the tax table when determining the tax. The

ESBT is taxed at the highest tax rate only for federal purposes.

• Look for a payment voucher if you have tax due on line 20 of Form M2. If you owe tax, your software package is required to include a

payment voucher when you print out a copy of your return. If you are paying your tax by check, you must complete and send this payment

voucher with your check to ensure your payment is credited properly.

• Verify that estimated tax payments were made. Some software programs may insert the amount of estimated tax payments that should

14

have been paid, not the amount of tax actually paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14