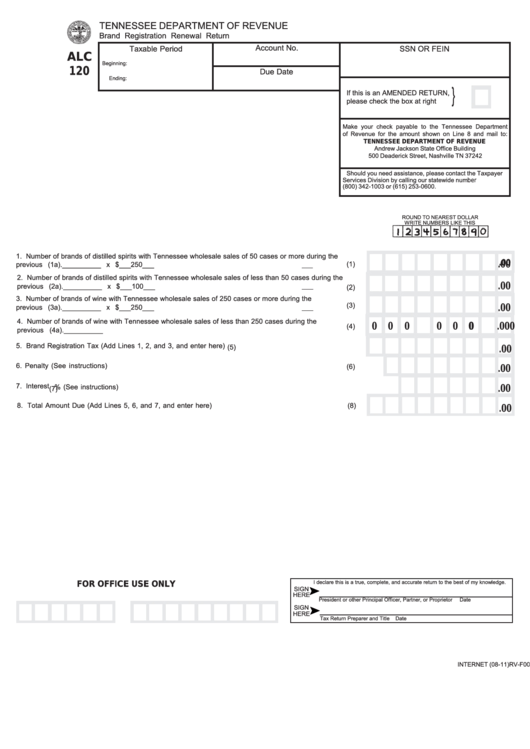

TENNESSEE DEPARTMENT OF REVENUE

Brand Registration Renewal Return

Account No.

Taxable Period

SSN OR FEIN

ALC

Beginning:

120

Due Date

Ending:

}

If this is an AMENDED RETURN,

please check the box at right

Make your check payable to the Tennessee Department

of Revenue for the amount shown on Line 8 and mail to:

TENNESSEE DEPARTMENT OF REVENUE

Andrew Jackson State Office Building

500 Deaderick Street, Nashville TN 37242

Should you need assistance, please contact the Taxpayer

Services Division by calling our statewide number

(800) 342-1003 or (615) 253-0600.

ROUND TO NEAREST DOLLAR

WRITE NUMBERS LIKE THIS

1. Number of brands of distilled spirits with Tennessee wholesale sales of 50 cases or more during the

(1)

.00

previous year..................................................................................(1a).__________ x $___250___.....

00

.

2. Number of brands of distilled spirits with Tennessee wholesale sales of less than 50 cases during the

previous year..................................................................................(2a).__________ x $___100___.....

(2)

00

.

3. Number of brands of wine with Tennessee wholesale sales of 250 cases or more during the

(3)

previous year..................................................................................(3a).__________ x $___250___.....

00

.

4. Number of brands of wine with Tennessee wholesale sales of less than 250 cases during the

(4)

0

0

0

0

0 0

0

0

00

.

previous year................................................................................(4a).__________

.............................

5. Brand Registration Tax (Add Lines 1, 2, and 3, and enter here).........................................................

(5)

00

.

6. Penalty (See instructions)....................................................................................................................

(6)

00

.

7. Interest

% (See instructions)......................................................................................................

(7)

00

.

8. Total Amount Due (Add Lines 5, 6, and 7, and enter here).................................................................

(8)

00

.

I declare this is a true, complete, and accurate return to the best of my knowledge.

FOR OFFICE USE ONLY

SIGN

HERE

President or other Principal Officer, Partner, or Proprietor

Date

SIGN

HERE

Tax Return Preparer and Title

Date

RV-F0012501

INTERNET (08-11)

1

1 2

2