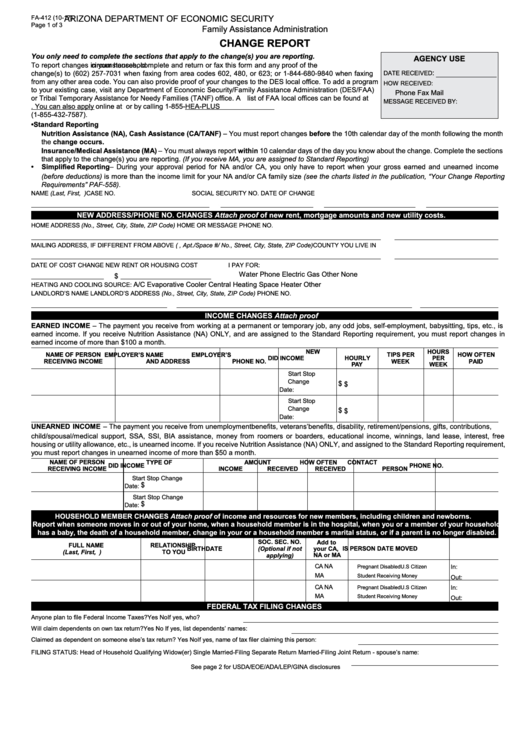

Form Fa-412 - Change Report

Download a blank fillable Form Fa-412 - Change Report in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Fa-412 - Change Report with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

–

–

–

’

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

FA-412 (10-17)

Page 1 of 3

Family Assistance Administration

CHANGE REPORT

You only need to complete the sections that apply to the change(s) you are reporting.

AGENCY USE

To report changes in your household circumstances, complete and return or fax this form and any proof of the

:

change(s) to (602) 257-7031 when faxing from area codes 602, 480, or 623; or 1-844-680-9840 when faxing

DATE RECEIVED

from any other area code. You can also provide proof of your changes to the DES local office. To add a program

HOW RECEIVED:

to your existing case, visit any Department of Economic Security/Family Assistance Administration (DES/FAA)

Phone

Fax

Mail

or Tribal Temporary Assistance for Needy Families (TANF) office. A list of FAA local offices can be found at

MESSAGE RECEIVED BY:

https://eol.azdes.gov. You can also apply online at or by calling 1-855-HEA-PLUS

(1-855-432-7587).

•

Standard Reporting

Nutrition Assistance (NA), Cash Assistance (CA/TANF) – You must report changes before the 10th calendar day of the month following the month

the change occurs.

Insurance/Medical Assistance (MA) – You must always report within 10 calendar days of the day you know about the change. Complete the sections

that apply to the change(s) you are reporting. (If you receive MA, you are assigned to Standard Reporting)

•

Simplified Reporting – During your approval period for NA and/or CA, you only have to report when your gross earned and unearned income

(before deductions) is more than the income limit for your NA and/or CA family size (see the charts listed in the publication, “Your Change Reporting

Requirements” PAF-558).

NAME (Last, First, M.I.)

CASE NO.

SOCIAL SECURITY NO.

DATE OF CHANGE

NEW ADDRESS/PHONE NO. CHANGES

Attach proof of new rent, mortgage amounts and new utility costs.

HOME ADDRESS (No., Street, City, State, ZIP Code)

HOME OR MESSAGE PHONE NO.

MAILING ADDRESS, IF DIFFERENT FROM ABOVE (P.O. Box, Apt./Space #/ No., Street, City, State, ZIP Code)

COUNTY YOU LIVE IN

DATE OF COST CHANGE

NEW RENT OR HOUSING COST

I PAY FOR:

Water

Phone

Electric

Gas

Other

None

$

A/C

Evaporative Cooler

Central Heating

Space Heater

Other

HEATING AND COOLING SOURCE:

LANDLORD’S NAME

LANDLORD’S ADDRESS (No., Street, City, State, ZIP Code)

PHONE NO.

INCOME CHANGES

Attach proof

EARNED INCOME – The payment you receive from working at a permanent or temporary job, any odd jobs, self-employment, babysitting, tips, etc., is

earned income. If you receive Nutrition Assistance (NA) ONLY, and are assigned to the Standard Reporting requirement, you must report changes in

earned income of more than $100 a month.

NEW

HOURS

NAME OF PERSON

EMPLOYER’S NAME

EMPLOYER’S

TIPS PER

HOW OFTEN

DID INCOME

HOURLY

PER

RECEIVING INCOME

AND ADDRESS

PHONE NO.

WEEK

PAID

PAY

WEEK

Start

Stop

Change

$

$

Date:

Start

Stop

Change

$

$

Date:

UNEARNED INCOME – The payment you receive from unemployment benefits, veterans’ benefits, disability, retirement/pensions, gifts, contributions,

child/spousal/medical support, SSA, SSI, BIA assistance, money from roomers or boarders, educational income, winnings, land lease, interest, free

housing or utility allowance, etc., is unearned income. If you receive Nutrition Assistance (NA) ONLY, and assigned to the Standard Reporting requirement,

you must report changes in unearned income of more than $50 a month.

NAME OF PERSON

TYPE OF

AMOUNT

HOW OFTEN

CONTACT

DID INCOME

PHONE NO.

RECEIVING INCOME

INCOME

RECEIVED

RECEIVED

PERSON

Start

Stop

Change

$

Date:

Start

Stop

Change

$

Date:

HOUSEHOLD MEMBER CHANGES

Attach proof of income and resources for new members, including children and newborns.

Report when someone moves in or out of your home, when a household member is in the hospital, when you or a member of your household

has a baby, the death of a household member, change in your or a household member s marital status, or if a parent is no longer disabled.

SOC. SEC. NO.

Add to

FULL NAME

RELATIONSHIP

BIRTHDATE

(Optional if not

your CA,

IS PERSON

DATE MOVED

(Last, First, M.I.)

TO YOU

applying)

NA or MA

CA

NA

Pregnant

Disabled

U.S Citizen

In:

MA

Student

Receiving Money

Out:

CA

NA

In:

Pregnant

Disabled

U.S Citizen

MA

Student

Receiving Money

Out:

FEDERAL TAX FILING CHANGES

Anyone plan to file Federal Income Taxes?

Yes

No

If yes, who?

Will claim dependents on own tax return?

Yes

No

If yes, list dependents’ names:

Claimed as dependent on someone else’s tax return?

Yes

No

If yes, name of tax filer claiming this person:

FILING STATUS:

Head of Household

Qualifying Widow(er)

Single

Married-Filing Separate Return

Married-Filing Joint Return - spouse’s name:

See page 2 for USDA/EOE/ADA/LEP/GINA disclosures

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3