Form Uc-514 - Report Of Changes

Download a blank fillable Form Uc-514 - Report Of Changes in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Uc-514 - Report Of Changes with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

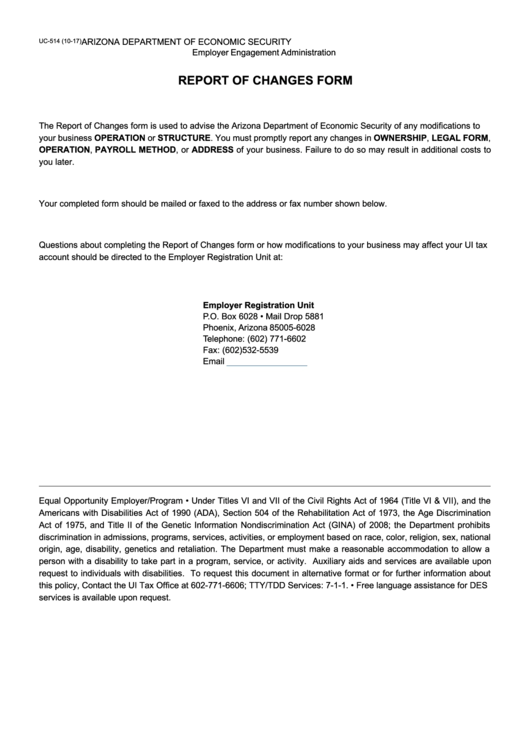

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

UC-514 (10-17)

Employer Engagement Administration

REPORT OF CHANGES FORM

The Report of Changes form is used to advise the Arizona Department of Economic Security of any modifications to

your business OPERATION or STRUCTURE. You must promptly report any changes in OWNERSHIP, LEGAL FORM,

OPERATION, PAYROLL METHOD, or ADDRESS of your business. Failure to do so may result in additional costs to

you later.

Your completed form should be mailed or faxed to the address or fax number shown below.

Questions about completing the Report of Changes form or how modifications to your business may affect your UI tax

account should be directed to the Employer Registration Unit at:

Employer Registration Unit

P.O. Box 6028 • Mail Drop 5881

Phoenix, Arizona 85005-6028

Telephone: (602) 771-6602

Fax: (602) 532-5539

Email

uitstatus@azdes.gov

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the

Americans with Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination

Act of 1975, and Title II of the Genetic Information Nondiscrimination Act (GINA) of 2008; the Department prohibits

discrimination in admissions, programs, services, activities, or employment based on race, color, religion, sex, national

origin, age, disability, genetics and retaliation. The Department must make a reasonable accommodation to allow a

person with a disability to take part in a program, service, or activity. Auxiliary aids and services are available upon

request to individuals with disabilities. To request this document in alternative format or for further information about

this policy, Contact the UI Tax Office at 602-771-6606; TTY/TDD Services: 7-1-1. • Free language assistance for DES

services is available upon request.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2