Form Pf1 - Propane Fee Return

Download a blank fillable Form Pf1 - Propane Fee Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Pf1 - Propane Fee Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

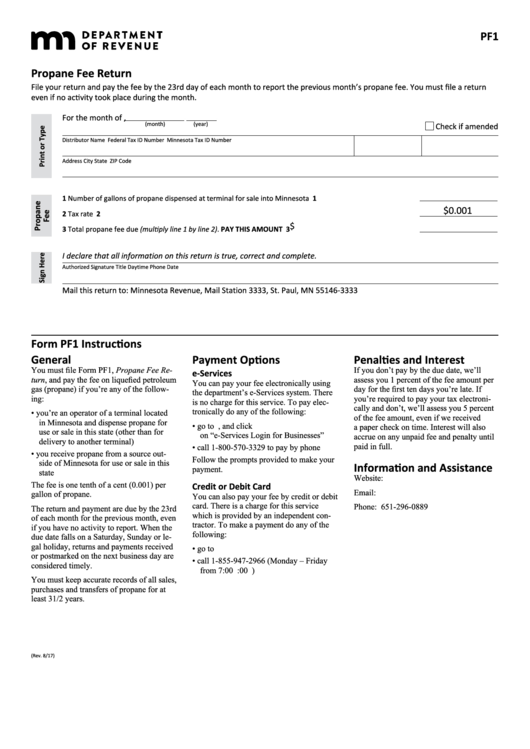

PF1

Propane Fee Return

File your return and pay the fee by the 23rd day of each month to report the previous month’s propane fee. You must file a return

even if no activity took place during the month.

For the month of

,

(month)

(year)

Check if amended

Distributor Name

Federal Tax ID Number

Minnesota Tax ID Number

Address

City

State

ZIP Code

1 Number of gallons of propane dispensed at terminal for sale into Minnesota . . . . . . . . . . . . . . . . . . . . . . . . 1

$0.001

2 Tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

$

3 Total propane fee due (multiply line 1 by line 2). PAY THIS AMOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

I declare that all information on this return is true, correct and complete.

Authorized Signature

Title

Daytime Phone

Date

Mail this return to: Minnesota Revenue, Mail Station 3333, St. Paul, MN 55146-3333

Form PF1 Instructions

General

Payment Options

Penalties and Interest

You must file Form PF1, Propane Fee Re-

If you don’t pay by the due date, we’ll

e-Services

turn, and pay the fee on liquefied petroleum

assess you 1 percent of the fee amount per

You can pay your fee electronically using

gas (propane) if you’re any of the follow-

day for the first ten days you’re late. If

the department’s e-Services system. There

ing:

you’re required to pay your tax electroni-

is no charge for this service. To pay elec-

cally and don’t, we’ll assess you 5 percent

tronically do any of the following:

• you’re an operator of a terminal located

of the fee amount, even if we received

in Minnesota and dispense propane for

• go to , and click

a paper check on time. Interest will also

use or sale in this state (other than for

on “e-Services Login for Businesses”

accrue on any unpaid fee and penalty until

delivery to another terminal)

paid in full.

• call 1-800-570-3329 to pay by phone

• you receive propane from a source out-

Follow the prompts provided to make your

side of Minnesota for use or sale in this

Information and Assistance

payment.

state

Website:

The fee is one tenth of a cent (0.001) per

Credit or Debit Card

Email:

petroleum.tax@state.mn.us

gallon of propane.

You can also pay your fee by credit or debit

card. There is a charge for this service

Phone: 651-296-0889

The return and payment are due by the 23rd

which is provided by an independent con-

of each month for the previous month, even

tractor. To make a payment do any of the

if you have no activity to report. When the

following:

due date falls on a Saturday, Sunday or le-

gal holiday, returns and payments received

• go to

or postmarked on the next business day are

• call 1-855-947-2966 (Monday – Friday

considered timely.

from 7:00 a.m. to 7:00 p.m.)

You must keep accurate records of all sales,

purchases and transfers of propane for at

least 31/2 years.

(Rev. 8/17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1