Instructions For Arizona Exempt Organization Annual Information Return (Arizona Form 99) - 2014 Page 3

ADVERTISEMENT

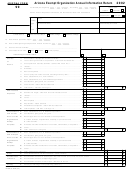

Arizona Form 99

Line 23 -

NOTE: The amounts entered on lines C2a, C2b, C3a, C3b,

C7a, and C7b and on any included schedules should be end

Enter all other disbursements not itemized on Schedule A or

of year amounts.

Schedule B. Include a schedule detailing these disbursements

with the return.

Line C2 -

Lines 24 through 26 -

On line C2a, enter accounts receivable. Subtract the amount

on line C2b from the amount on line C2a. Enter the

Enter the applicable amounts to report the accumulation of

difference on line C2c in column (b).

income.

Line C3 -

Line 27 -

On line C3a, enter other notes and loans receivable. Subtract

This form is an information return. An information return

the amount on line C3b from the amount on line C3a. Enter

that is incomplete or filed after its due date (including

the difference on line C3c in column (b).

extensions) is subject to a penalty of $100 for each month,

or fraction of a month, that the failure continues, up to a

Line C7 -

maximum penalty of $500.

On line C7a, enter land, buildings, and equipment; basis.

If the organization or dispensary files this return after its due

Subtract the amount on line C7b from the amount on

date (including extensions), enter the penalty due on this line.

line C7a. Enter the difference on line C7c in column (b).

Payments can be made via check or money order.

Certification

Make checks payable to Arizona Department of Revenue.

Enter the organization's EIN or the dispensary’s TIN on the

An officer of the organization or dispensary must sign the

front of the check or money order. Include the check or

return on page 3.

money order with the return.

Paid preparers: Sign and date the return on page 3.

Complete the firm name and address lines (the paid

Schedule C - Balance Sheet

preparer’s name and address, if self-employed). Enter the

Complete column (a), for beginning of year amounts, and

paid preparer’s TIN, which is the firm’s EIN or the individual

column (b), for end of year amounts.

preparer’s social security number.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3