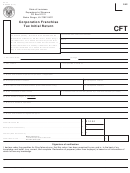

Instructions for corporation Franchise Tax Initial Return

Every new corporation subject to franchise tax must file an initial return and pay the initial tax of $10.00. This return is due on or before

the fifteenth day of the third month following the month in which the tax accrues. For a domestic corporation, the tax accrues on the date

shown on the charter issued by the Secretary of State. For a foreign corporation, the tax accrues on the date the corporation exercises its

charter in Louisiana, is authorized to do, actually does business in Louisiana, or uses any part of its capital or plant in Louisiana. Example

due dates are as follows: The tax of ABC accrued on March 21, 2013; its initial return and payment of $10.00 tax would be due on or before

June 15, 2013. If ABC adopted a calendar year accounting period, this initial payment would cover the period March 21, 2013 through

December 31, 2013. The next franchise return would be due on or before April 15, 2014, and must be filed on Form CIFT-620. If the fiscal

year ending June 30, 2013 was adopted, the initial return would cover the period from March 21, 2013 through June 30, 2013. The next

franchise return would be due on or before October 15, 2013, and must be filed on Form CIFT-620. Delinquent returns and payments must

include applicable penalty and interest. If the due date falls on a holiday or weekend, the return must be transmitted on or before the next

business day in order to avoid penalty and interest.

Corporation franchise tax for domestic corporations continues to accrue and must be filed on Form CIFT-620, regardless of whether any

assets are owned or any business operations are conducted, until a “Certificate of Dissolution” is issued by the Louisiana Secretary of State.

Corporation franchise tax for foreign corporations continues to accrue and must be filed on Form CIFT-620, as long as the corporation

exercises its charter, does business, or owns or uses any part of its capital or plant in Louisiana and, in the case of a qualified corporation,

until a “Certificate of Withdrawal” is issued by the Louisiana Secretary of State.

Line 1a.

Enter the period covered by this initial franchise tax return. The period begins on the date the charter is filed with the Secre-

tary of State, or the date of Louisiana qualification, or other taxing incidence. The period ends on the date the first accounting

period closes. If books are kept on a calendar year basis, the period covered must end on the last day of December. If a fiscal

year basis is used, the period must end on the last day of any month and cannot exceed 12 months.

Line 1b.

Enter the month your accounting period closes. The month should match the period ends date on Line 1a.

Line 2.

Enter the Federal Employer’s Identification Number for the corporation.

Line 3.

Enter the state where the corporation was originally incorporated.

Line 4.

If the corporation is the successor to an existing business (i.e., through a merger or the incorporation of an existing entity,

such as a partnership), enter the name and address of the former business or owner.

Line 5.

If the corporation is a subsidiary of another corporation, enter the name and address of the parent corporation.

Line 6a.

Enter the city and state of the principal place of business. Enter the telephone number on line 6b.

Line 7a.

Enter the primary Louisiana office location. Provide a physical address of the primary location: street address, city, state, and

zip code.

Line 7b.

Enter the telephone number.

Line 8a.

Enter the date (month, day, year) the Louisiana charter was issued.

Line 8b.

Enter the charter number assigned to this corporation by the Louisiana Secretary of State.

Line 9a.

Enter the date (month, day, year) this corporation began business in Louisiana.

Line 9b.

Describe the nature of the business operations in Louisiana.

Line 10.

Enter the parishes in Louisiana where corporate property is located.

Line 11.

Enter the name and address of the registered agent for this corporation as recorded with the Louisiana Secretary of State.

Line 12.

The initial franchise tax due is $10.00.

Line 13.

Calculate Delinquent Filing Penalty for failure to file a return timely. The penalty for failure to file a return on time, except when

failure is due to a reasonable cause, is 5 percent of the tax for each 30 days or fraction thereof during which the failure to file

continues.

Calculate Delinquent Payment Penalty for failure to pay the tax in full by the date the return is required by law to be filed. The

penalty is 5 percent of the tax not paid for each 30 days, or fraction thereof, during which the failure to pay continues.

Add the amounts calculated for each penalty and print the total amount of penalties. The combined amount of delinquent

filing and delinquent payment penalties cannot exceed 25 percent.

Line 14.

Interest is due on all items of tax not paid by the due date of the return. Because the interest rate varies year to year, the

Department is unable to provide a specific rate. Refer to the Tax Rate Schedule (R-1111) for monthly interest rates that apply.

Form R-1111 is available on the LDR’s website at Calculate the interest amount and print the

amount of interest here.

Line 15.

Add the total penalty and interest due to the franchise tax amount of $10.00 and enter the total on Line 15. Make payment to

the Louisiana Department of Revenue. Do NoT seND cash.

The return must be signed by either the president, vice-president, treasurer, or another authorized officer. The telephone number of the

officer should be furnished. Any person, firm or corporation who prepares a taxpayer’s return other than the taxpayer, must sign the return

as a representative of the firm or corporation preparing the return. This verification is not required if the return is prepared by a regular

full-time employee of the taxpayer. The telephone number of the preparer should also be furnished.

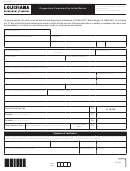

sPec

This space on the first page of the tax return is to be used only when specifically instructed by the Department

coDe

of Revenue. Otherwise, leave blank.

1

1 2

2