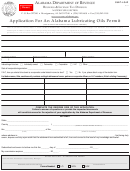

Sliding Scale Market Value Exclusion Application Instructions

Efficiency Determination

If you are an owner or operator of

•

A right of first refusal

a new or existing electric power

In the area provide, list all inputs

satisfies the good faith offer

generation facility (other than wind

including fuel inputs, necessary to

requirement. The

energy conversion systems), you

generate electric power and for

commission has 90 days

may be able to reduce the taxable

production of other outputs (list

from the date the

market value of your facility’s

amounts and BTUs of all inputs.)

commission receives notice

equipment.

Use additional sheets if necessary.

of the application to make

this determination.

This exclusion does not apply to

Use of Information

the market value of the facility’s

• The electric utility – an

structure or the land upon which it

You are not required by law to

entity whose primary

is located.

provide this information.

business function is to

However, if you want a sliding

If the property is located in two or

operate, maintain or control

scale market value exclusion you

more counties, cities, townships

equipment or facilities for

must provide all of the requested

or school districts, you must apply

providing electric service at

information.

separately for each taxing district

retail or wholesale, and

All of the information requested on

in which the property is located.

includes distribution

this form is public.

cooperative electric

The sliding scale market value

associations, generation and

File Electronically

exclusion is valid for two

transmission cooperative

assessment years. You may file

You may submit this completed

electric associations,

renewal applications for the

application electronically at

municipal utilities and

exclusion for additional two-year

sa.property@state.mn.us. Be sure

public utilities – has agreed

periods.

to include all supporting materials.

in advance not to offer the

Eligibility Requirements

electric power for resale to a

Questions?

retail customer located

If you are an owner or operator

If you need help completing this

outside of the utility’s

of a new or existing electric

application, call 651-556-6119.

assigned service area, or, if

power generation facility who

TTY: Call 711 for Minnesota

the utility is a generation

offers electric power generated

Relay.

and transmission

by the facility for sale, you may

Email

cooperative electric

be eligible for an exclusion if you

association, the assigned

sa.property@state.mn.us

meet all four requirements below:

service area of its members;

Address

• You received a certificate

and

Minnesota Revenue

of need, if required

Mail Station 3340

• Any facility that was not

St. Paul, MN 55156-3340

• The Public Utilities

eligible for the sliding

Commission finds that an

Forms

scale market value

agreement exists or a good

exclusion for property taxes

Forms and other tax information

faith offer has been made

payable in 2015, the

are available on our website at

to sell the majority of the

facility must be converted

net power generated by the

from coal to an alternative

We will provide this information

facility to an electric utility

fuel and must have a

in other formats upon request to

which has demonstrated

nameplate capacity prior to

persons with disabilities.

need for the power.

conversion of less than 75

megawatts.

1

1 2

2