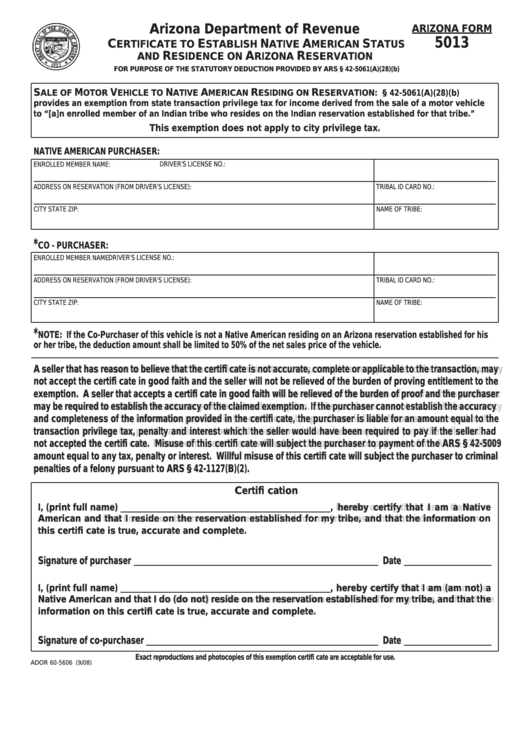

Arizona Form 5013 - Certificate To Establish Native American Status And Residence On Arizona Reservation

ADVERTISEMENT

Arizona Department of Revenue

ARIZONA FORM

5013

C

E

N

A

S

ERTIFICATE TO

STABLISH

ATIVE

MERICAN

TATUS

R

A

R

AND

ESIDENCE ON

RIZONA

ESERVATION

FOR PURPOSE OF THE STATUTORY DEDUCTION PROVIDED BY ARS § 42-5061(A)(28)(b)

S

M

V

N

A

R

R

ALE OF

OTOR

EHICLE TO

ATIVE

MERICAN

ESIDING ON

ESERVATION: A.R.S. § 42-5061(A)(28)(b)

provides an exemption from state transaction privilege tax for income derived from the sale of a motor vehicle

to “[a]n enrolled member of an Indian tribe who resides on the Indian reservation established for that tribe.”

This exemption does not apply to city privilege tax.

NATIVE AMERICAN PURCHASER:

ENROLLED MEMBER NAME:

DRIVER’S LICENSE NO.:

ADDRESS ON RESERVATION (FROM DRIVER’S LICENSE):

TRIBAL ID CARD NO.:

CITY STATE ZIP:

NAME OF TRIBE:

*

CO - PURCHASER:

ENROLLED MEMBER NAME:

DRIVER’S LICENSE NO.:

ADDRESS ON RESERVATION (FROM DRIVER’S LICENSE):

TRIBAL ID CARD NO.:

CITY STATE ZIP:

NAME OF TRIBE:

*

NOTE: If the Co-Purchaser of this vehicle is not a Native American residing on an Arizona reservation established for his

or her tribe, the deduction amount shall be limited to 50% of the net sales price of the vehicle.

A seller that has reason to believe that the certifi cate is not accurate, complete or applicable to the transaction, may

A seller that has reason to believe that the certifi cate is not accurate, complete or applicable to the transaction, may

not accept the certifi cate in good faith and the seller will not be relieved of the burden of proving entitlement to the

not accept the certifi cate in good faith and the seller will not be relieved of the burden of proving entitlement to the

exemption. A seller that accepts a certifi cate in good faith will be relieved of the burden of proof and the purchaser

exemption. A seller that accepts a certifi cate in good faith will be relieved of the burden of proof and the purchaser

may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish the accuracy

may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish the accuracy

and completeness of the information provided in the certifi cate, the purchaser is liable for an amount equal to the

and completeness of the information provided in the certifi cate, the purchaser is liable for an amount equal to the

transaction privilege tax, penalty and interest which the seller would have been required to pay if the seller had

transaction privilege tax, penalty and interest which the seller would have been required to pay if the seller had

not accepted the certifi cate. Misuse of this certifi cate will subject the purchaser to payment of the ARS § 42-5009

not accepted the certifi cate. Misuse of this certifi cate will subject the purchaser to payment of the ARS § 42-5009

amount equal to any tax, penalty or interest. Willful misuse of this certifi cate will subject the purchaser to criminal

amount equal to any tax, penalty or interest. Willful misuse of this certifi cate will subject the purchaser to criminal

penalties of a felony pursuant to ARS § 42-1127(B)(2).

penalties of a felony pursuant to ARS § 42-1127(B)(2).

Certifi cation

Certifi cation

I, (print full name)

I, (print full name)

, hereby certify that I am a Native

, hereby certify that I am a Native

American and that I reside on the reservation established for my tribe, and that the information on

American and that I reside on the reservation established for my tribe, and that the information on

this certifi cate is true, accurate and complete.

this certifi cate is true, accurate and complete.

Signature of purchaser

Signature of purchaser

Date

Date

I, (print full name)

I, (print full name)

, hereby certify that I am (am not) a

, hereby certify that I am (am not) a

Native American and that I do (do not) reside on the reservation established for my tribe, and that the

Native American and that I do (do not) reside on the reservation established for my tribe, and that the

information on this certifi cate is true, accurate and complete.

information on this certifi cate is true, accurate and complete.

Signature of co-purchaser

Signature of co-purchaser

Date

Date

Exact reproductions and photocopies of this exemption certifi cate are acceptable for use.

ADOR 60-5606 (9/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1