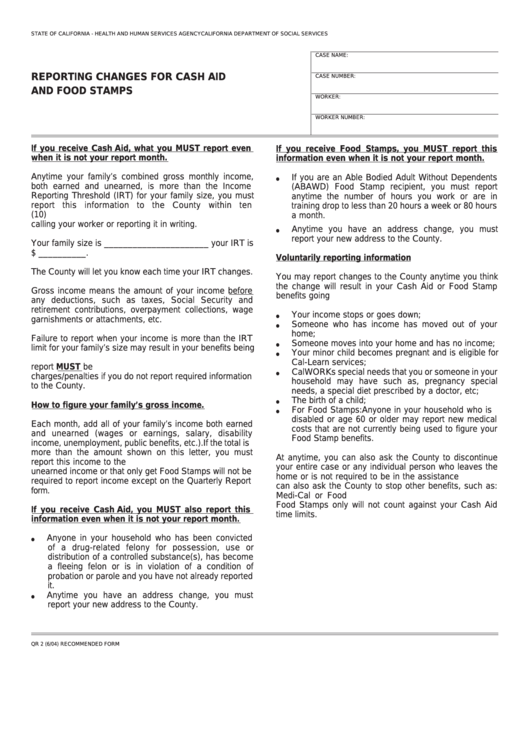

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

CASE NAME:

REPORTING CHANGES FOR CASH AID

CASE NUMBER:

AND FOOD STAMPS

WORKER:

WORKER NUMBER:

If you receive Cash Aid, what you MUST report even

If you receive Food Stamps, you MUST report this

when it is not your report month.

information even when it is not your report month.

Anytime your family’s combined gross monthly income,

If you are an Able Bodied Adult Without Dependents

both earned and unearned, is more than the Income

(ABAWD) Food Stamp recipient, you must report

Reporting Threshold (IRT) for your family size, you must

anytime the number of hours you work or are in

report this information to the County within ten

training drop to less than 20 hours a week or 80 hours

(10) days. You can report this information to the County by

a month.

calling your worker or reporting it in writing.

Anytime you have an address change, you must

report your new address to the County.

Your family size is ______________________ your IRT is

$ __________.

Voluntarily reporting information

The County will let you know each time your IRT changes.

You may report changes to the County anytime you think

the change will result in your Cash Aid or Food Stamp

Gross income means the amount of your income before

benefits going up. For example.

any deductions, such as taxes, Social Security and

retirement contributions, overpayment collections, wage

Your income stops or goes down;

garnishments or attachments, etc.

Someone who has income has moved out of your

home;

Failure to report when your income is more than the IRT

Someone moves into your home and has no income;

limit for your family’s size may result in your benefits being

Your minor child becomes pregnant and is eligible for

overpaid. Any overpaid benefits caused by your failure to

Cal-Learn services;

report MUST be repaid. You may also be subject to fraud

CalWORKs special needs that you or someone in your

charges/penalties if you do not report required information

household may have such as, pregnancy special

to the County.

needs, a special diet prescribed by a doctor, etc;

The birth of a child;

How to figure your family’s gross income.

For Food Stamps: Anyone in your household who is

disabled or age 60 or older may report new medical

Each month, add all of your family’s income both earned

costs that are not currently being used to figure your

and unearned (wages or earnings, salary, disability

Food Stamp benefits.

income, unemployment, public benefits, etc.). If the total is

more than the amount shown on this letter, you must

At anytime, you can also ask the County to discontinue

report this income to the County. Families that only have

your entire case or any individual person who leaves the

unearned income or that only get Food Stamps will not be

home or is not required to be in the assistance unit. You

required to report income except on the Quarterly Report

can also ask the County to stop other benefits, such as:

form.

Medi-Cal or Food Stamps. Receiving Medi-Cal and/or

Food Stamps only will not count against your Cash Aid

If you receive Cash Aid, you MUST also report this

time limits.

information even when it is not your report month.

Anyone in your household who has been convicted

of a drug-related felony for possession, use or

distribution of a controlled substance(s), has become

a fleeing felon or is in violation of a condition of

probation or parole and you have not already reported

it.

Anytime you have an address change, you must

report your new address to the County.

QR 2 (6/04) RECOMMENDED FORM

1

1