Form Gt-800019 - Florida'S Discretionary Sales Surtax

ADVERTISEMENT

GT-800019

R. 12/17

Florida’s Discretionary Sales

Surtax

How it applies to transactions subject to sales and use tax, including sales of

motor vehicles, mobile homes, aircraft, and boats.

What is Discretionary Sales Surtax?

Discretionary sales surtax, also called a county tax, is imposed by most Florida counties and

applies to most transactions subject to sales tax. The selling dealer must collect the surtax in

addition to Florida’s general sales tax of 6 percent. The discretionary sales surtax is based on the

rate in the county where you deliver taxable goods or services. A few counties do not impose the

surtax.

The Department of Revenue distributes the discretionary sales surtax collected back to the

counties that levy the surtax. Counties use these funds to help pay for local authorized projects.

Who Collects the Surtax?

Registered sales tax dealers, including out-of-state dealers, who sell and deliver taxable goods or

services within a county with a discretionary sales surtax must collect the tax from their customers

and pay the surtax to the Department. This applies to all selling dealers who make sales or

deliveries into a taxing county, no matter where the selling dealer is located.

Selling dealers do not collect surtax when the sale or delivery of taxable goods or services is in or into

a county that does not impose a surtax.

When is a Transaction Subject to Surtax?

You must collect discretionary sales surtax when the transaction occurs in, or delivery is into, a

county that imposes a surtax and the sale is subject to sales and use tax. Use the chart below to

help you determine when to collect discretionary sales surtax.

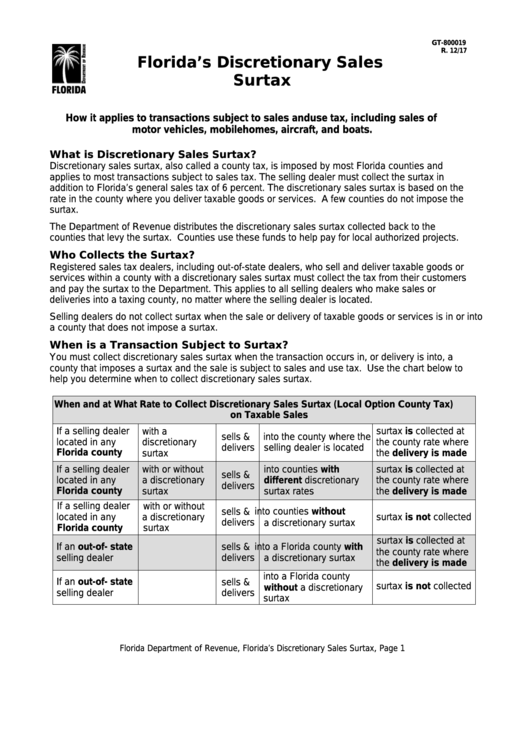

When and at What Rate to Collect Discretionary Sales Surtax (Local Option County Tax)

on Taxable Sales

If a selling dealer

with a

surtax is collected at

sells &

into the county where the

located in any

the county rate where

discretionary

delivers

selling dealer is located

Florida county

surtax

the delivery is made

surtax is collected at

If a selling dealer

with or without

into counties with

sells &

the county rate where

located in any

a discretionary

different discretionary

delivers

Florida county

surtax

surtax rates

the delivery is made

If a selling dealer

with or without

sells &

into counties without

located in any

a discretionary

surtax is not collected

delivers

a discretionary surtax

Florida county

surtax

surtax is collected at

If an out-of- state

sells &

into a Florida county with

the county rate where

delivers

selling dealer

a discretionary surtax

the delivery is made

into a Florida county

If an out-of- state

sells &

surtax is not collected

without a discretionary

selling dealer

delivers

surtax

Florida Department of Revenue, Florida’s Discretionary Sales Surtax, Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4