Form Gt-800021 - Florida Taxes On Laundering, Dry Cleaning, And Alterations

ADVERTISEMENT

GT-800021

R. 12/17

Florida Taxes on Laundering,

Dry Cleaning, and Alterations

Gross Receipts Tax

What is Taxable?

A 2% tax is imposed on the gross receipts received by dry-cleaning and dry drop-off facilities on charges

for:

•

Laundering clothing and other fabrics

•

Dry cleaning clothing and other fabrics

There is a $5 per gallon tax on the sale of perchloroethylene to dry-cleaning facilities located in Florida.

What Is Exempt?

The tax does not apply to receipts from:

•

Coin-operated laundry machines, unless operated at a dry-cleaning establishment

•

Laundry done on a wash, dry, and fold basis

•

Uniform rental companies

•

Linen supply service companies

Entities that are exempt from paying sales and use tax, such as political subdivisions, nonprofit religious

institutions, or veterans’ organizations, are not exempt from paying gross receipts tax.

Customer Receipts

Customer receipts for dry-cleaning services that separately itemize the gross receipts tax or the $5 per

gallon tax on perchloroethylene must also include the following statement:

“The imposition of this tax was requested by the Florida Drycleaners Coalition.”

Resale Certificate

The receipts from dry-cleaning and laundering services at dry-cleaning or dry drop-off facilities who

resell the services to their customers are exempt. The dry-cleaning or dry drop-off facility must obtain a

Resale Certificate for Gross Receipts Tax from the purchasing facility. The selling facility is only

required to obtain one certificate from each purchasing facility.

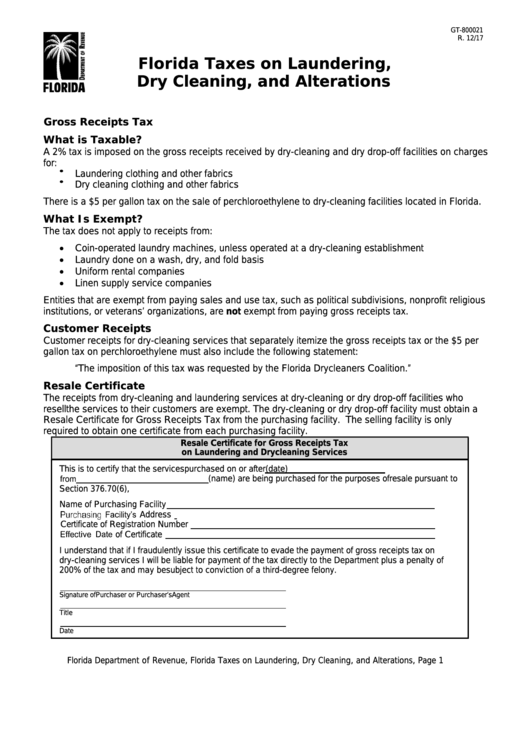

Resale Certificate for Gross Receipts Tax

on Laundering and Drycleaning Services

This is to certify that the services purchased on or after

(date)

(name) are being purchased for the purposes of resale pursuant to

Section 376.70(6), F.S.

Name of Purchasing Facility

Address

Certificate of Registration Number

of Certificate

I understand that if I fraudulently issue this certificate to evade the payment of gross receipts tax on

dry-cleaning services I will be liable for payment of the tax directly to the Department plus a penalty of

200% of the tax and may be subject to conviction of a third-degree felony.

Signature of Purchaser or Purchaser’s Agent

Title

Date

Florida Department of Revenue, Florida Taxes on Laundering, Dry Cleaning, and Alterations, Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3