Form Dr-156r Draft - Renewal Application For Florida Fuel/pollutants License Page 6

ADVERTISEMENT

DR-156R

R. 01/18

Page 5

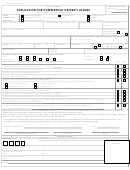

16. Pollutants storage information

Will this business produce, import, or remove petroleum pollutants through a terminal rack in this state? YES

NO

If “YES” (check appropriate box(es)):

Produce

Import or cause to be imported (into Florida)

Export

Be entitled to a refund on the following taxable pollutants:

Petroleum products

Ammonia

Pesticides

Chlorine

Motor oil or other lubricants

Crude Oil

Solvents

Perchloroethylene

Other (specify) _____________________________________________________________________________

List the type of pollutant, location of storage facility, and estimated volume of taxable units imported, produced,

or sold in Florida.

Type of Pollutant

Location of Storage Facility

Taxable Units

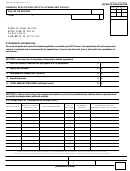

17.

Bond information

The license categories shown below usually require a bond. A wholesaler who has no import or export activity that sells

only undyed diesel fuel and that is not authorized by the Department to remit fuel tax to its supplier is not required to

have a bond. An applicant applying for a pollutants tax license for the sole purpose of applying for refunds pursuant to

section 206.9942, F.S., of tax-paid pollutants is not required to post a bond. Please list the information on the bonds

your business currently has secured.

Bond Type

Bond Company Name

Bond Company FEIN

Bond Number

Bond Amount

Motor Fuel

Diesel Fuel

Aviation Fuel

Importer’s Bond

Exporter’s Bond

Pollutants

18. List all suppliers of pollutants.

Name of Supplier

License Number

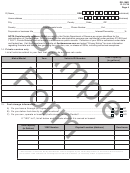

Licensing Information

19.

Do you wholesale motor, diesel or aviation fuel? __________________________________

NO

YES

20. A) Are you registered to collect and/or remit sales tax? .................................................... YES NO

B) If “YES,” what is your sales tax registration number? _______________________________________

21.

Will this business import fuels into Florida upon which there has been

no prior collection of tax?...................................................................................................

YES

NO

22. Do you blend untaxed products for use as motor fuel, diesel fuel or aviation fuel? ........

YES

NO

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7