Form Rts-8 - Firm'S Statement Of Claimant'S Work And Earnings

ADVERTISEMENT

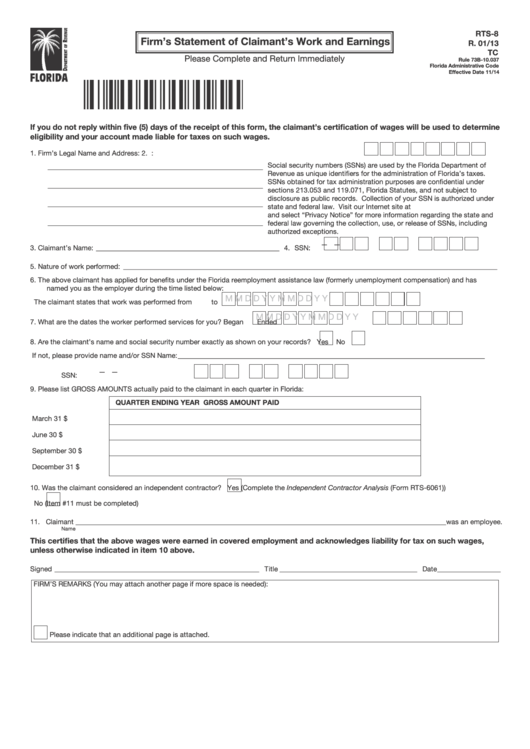

RTS-8

Firm’s Statement of Claimant’s Work and Earnings

R. 01/13

TC

Please Complete and Return Immediately

Rule 73B-10.037

Florida Administrative Code

Effective Date 11/14

If you do not reply within five (5) days of the receipt of this form, the claimant’s certification of wages will be used to determine

eligibility and your account made liable for taxes on such wages.

1.

Firm’s Legal Name and Address:

2. R.T. Account No.:

Social security numbers (SSNs) are used by the Florida Department of

_____________________________________________________________

Revenue as unique identifiers for the administration of Florida’s taxes.

SSNs obtained for tax administration purposes are confidential under

_____________________________________________________________

sections 213.053 and 119.071, Florida Statutes, and not subject to

disclosure as public records. Collection of your SSN is authorized under

_____________________________________________________________

state and federal law. Visit our Internet site at

and select “Privacy Notice” for more information regarding the state and

_____________________________________________________________

federal law governing the collection, use, or release of SSNs, including

authorized exceptions.

—

—

3.

Claimant’s Name: ____________________________________________________

4. SSN:

5.

Nature of work performed: __________________________________________________________________________________________________________

6.

The above claimant has applied for benefits under the Florida reemployment assistance law (formerly unemployment compensation) and has

named you as the employer during the time listed below:

M M D D

Y

Y

M M D D

Y

Y

The claimant states that work was performed from

to

M M D D

Y

Y

M M D D

Y

Y

7.

What are the dates the worker performed services for you? Began

Ended

8.

Are the claimant’s name and social security number exactly as shown on your records?

Yes

No

If not, please provide name and/or SSN

Name: _______________________________________________________________________________________

—

—

SSN:

9.

Please list GROSS AMOUNTS actually paid to the claimant in each quarter in Florida:

QUARTER ENDING

YEAR

GROSS AMOUNT PAID

March 31

$

June 30

$

September 30

$

December 31

$

10. Was the claimant considered an independent contractor?

Yes (Complete the Independent Contractor Analysis (Form RTS-6061))

No (Item #11 must be completed)

11. Claimant _________________________________________________________________________________________________________was an employee.

Name

This certifies that the above wages were earned in covered employment and acknowledges liability for tax on such wages,

unless otherwise indicated in item 10 above.

Signed __________________________________________________________ Title _______________________________________ Date __________________

FIRM’S REMARKS (You may attach another page if more space is needed):

Please indicate that an additional page is attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1