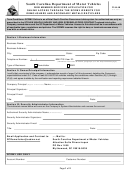

Form Dr-1sn - Registration Application For Secondhand Dealers And Secondary Metals Recyclers

ADVERTISEMENT

Registration Application for Secondhand Dealers

DR-1SN

N. 01/17

and Secondary Metals Recyclers

TC

Rule 12A-17.005

Florida Administrative Code

Instructions

Effective 01/17

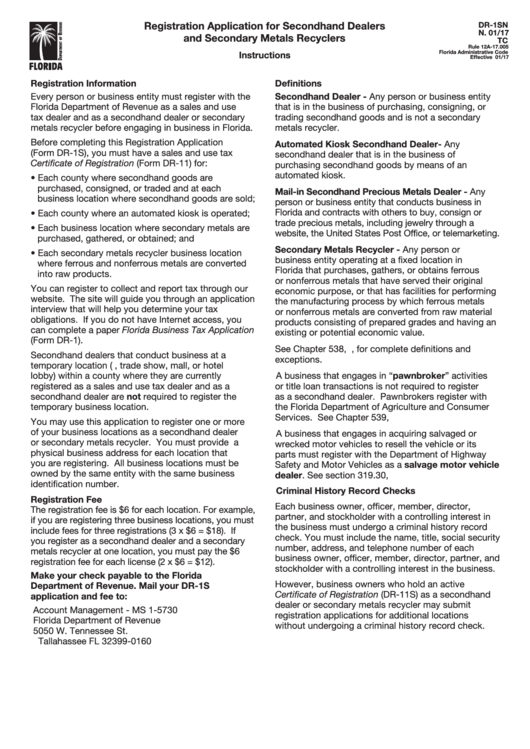

Registration Information

Definitions

Every person or business entity must register with the

Secondhand Dealer - Any person or business entity

Florida Department of Revenue as a sales and use

that is in the business of purchasing, consigning, or

tax dealer and as a secondhand dealer or secondary

trading secondhand goods and is not a secondary

metals recycler before engaging in business in Florida.

metals recycler.

Before completing this Registration Application

Automated Kiosk Secondhand Dealer - Any

(Form DR-1S), you must have a sales and use tax

secondhand dealer that is in the business of

Certificate of Registration (Form DR-11) for:

purchasing secondhand goods by means of an

automated kiosk.

• Each county where secondhand goods are

purchased, consigned, or traded and at each

Mail-in Secondhand Precious Metals Dealer - Any

business location where secondhand goods are sold;

person or business entity that conducts business in

Florida and contracts with others to buy, consign or

• Each county where an automated kiosk is operated;

trade precious metals, including jewelry through a

• Each business location where secondary metals are

website, the United States Post Office, or telemarketing.

purchased, gathered, or obtained; and

Secondary Metals Recycler - Any person or

• Each secondary metals recycler business location

business entity operating at a fixed location in

where ferrous and nonferrous metals are converted

Florida that purchases, gathers, or obtains ferrous

into raw products.

or nonferrous metals that have served their original

You can register to collect and report tax through our

economic purpose, or that has facilities for performing

website. The site will guide you through an application

the manufacturing process by which ferrous metals

interview that will help you determine your tax

or nonferrous metals are converted from raw material

obligations. If you do not have Internet access, you

products consisting of prepared grades and having an

can complete a paper Florida Business Tax Application

existing or potential economic value.

(Form DR-1).

See Chapter 538, F.S., for complete definitions and

Secondhand dealers that conduct business at a

exceptions.

temporary location (e.g., trade show, mall, or hotel

lobby) within a county where they are currently

A business that engages in “pawnbroker” activities

registered as a sales and use tax dealer and as a

or title loan transactions is not required to register

secondhand dealer are not required to register the

as a secondhand dealer. Pawnbrokers register with

temporary business location.

the Florida Department of Agriculture and Consumer

Services. See Chapter 539, F.S.

You may use this application to register one or more

of your business locations as a secondhand dealer

A business that engages in acquiring salvaged or

or secondary metals recycler. You must provide a

wrecked motor vehicles to resell the vehicle or its

physical business address for each location that

parts must register with the Department of Highway

you are registering. All business locations must be

Safety and Motor Vehicles as a salvage motor vehicle

owned by the same entity with the same business

dealer. See section 319.30, F.S.

identification number.

Criminal History Record Checks

Registration Fee

Each business owner, officer, member, director,

The registration fee is $6 for each location. For example,

partner, and stockholder with a controlling interest in

if you are registering three business locations, you must

the business must undergo a criminal history record

include fees for three registrations (3 x $6 = $18). If

check. You must include the name, title, social security

you register as a secondhand dealer and a secondary

number, address, and telephone number of each

metals recycler at one location, you must pay the $6

business owner, officer, member, director, partner, and

registration fee for each license (2 x $6 = $12).

stockholder with a controlling interest in the business.

Make your check payable to the Florida

However, business owners who hold an active

Department of Revenue. Mail your DR-1S

Certificate of Registration (DR-11S) as a secondhand

application and fee to:

dealer or secondary metals recycler may submit

Account Management - MS 1-5730

registration applications for additional locations

Florida Department of Revenue

without undergoing a criminal history record check.

5050 W. Tennessee St.

Tallahassee FL 32399-0160

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5