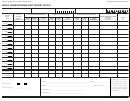

COST REPORT (SR 3)

PURPOSE:

The Group Home Program Cost Report (SR 3) captures monthly data on the actual, allowable and reasonable costs of the group home program.

INSTRUCTIONS FOR COMPLETION:

Submit one report per group home program. If the non-profit corporation provides services other than those of the group home program, (e.g., day care, on-site education, adult services,

foster family agency) costs must be allocated to the appropriate activity and only the allowable group home program costs for one program is to be reported. Describe the methodology used

to allocate costs if other than the standard allocation methodology indicated in the current Foster Care Group Home Regulations (MPP Section 11-402.8 et seq.). Please report all amounts

to the nearest whole dollar amounts.

Corporate/Licensee Name: Enter the Corporate/Licensee name shown on the most recent Group Home Program Rate Application (SR 1).

Program Name: Enter the Program Name if different from the Corporate/Licensee name.

Corporate Number: Enter the corporate number issued by the California Secretary of State.

Program Number: Enter number previously assigned by the Department (e.g., 1234.00.01) or specify “No number assigned yet.”

Reporting Period: For an existing provider, each cost report shall be based on actual fiscal data consistent with the provider’s most recent fiscal year. For the reporting period enter the

first month and year and the last month and year for the fiscal year. For a new provider, enter data from the first month of operation through the last month of the provider’s fiscal year and

enter the months for the time period covered in the space provided.

Number of months in cost report period: Enter the number of months for the cost period. For a full fiscal year, enter “12” and enter the months for the time period covered in the space

provided.

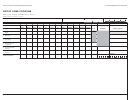

COSTS GROUPS: THE NINE COST GROUP DEFINITIONS ARE AS FOLLOWS:

1.

Child Care and Supervision (CCS): All costs related to the hours of CCS reported in the Program Classification Report (SR 2) are to be reported. These include functions of

day-to-day care of the child that would be considered ordinary parental duties and supervision by the caregiver. Do not include social work activities. Include payroll taxes and

employee benefits.

2.

Social Work Activities: All costs related to direct social work services which include development of needs, services and discharge plans, group and individual counseling and

worker-child interaction. Include payroll, payroll taxes and employee benefits, and contract costs (if social worker is on contract).

3.

Food: All costs related to food planning, preparation and service kitchen supplies and foodstuffs. Include food worker payroll, payroll tax and employee benefits, food expense and

kitchen supplies.

4a. Shelter Costs - Building Rent and Leases: All costs related to actual lease or rental costs, use allowance for capital improvements, taxes, building insurance, and appraisals for

leased or rented property.

4b. Shelter Costs - Affiliated Leases, Self-Dealing Transactions: Costs related to affiliated leases, self-dealing transactions.

4c. Shelter Costs - Acquisition Mortgage Principal & Interest: All costs related to property owned by the corporation for which the corporation has clear title or a mortgage or deed of

trust. Acquisition mortgage and principle must be reported. Include mortgage loans associated with the original financing arrangement. Include use allowance for capital improvements,

taxes, building insurance, and appraisals for owned property.

5.

Building and Equipment: Include building equipment, payroll, payroll taxes and employee benefits, building maintenance, contracts, supplies, equipment leases, equipment

depreciation expenses, expendable equipment, and miscellaneous building and equipment expenses.

6.

Utilities: Utilities include the cost of electricity, natural gas, water, garbage, and sewer.

7.

Vehicles & Travel: Include vehicle leases, depreciation, operating costs and transportation of the child. Reasonable annual depreciation or lease costs for automobiles are subject to

Internal Revenue Service guidelines for business use that are in effect at the time vehicle costs are incurred. Vehicle costs incurred from leaseback transactions are unallowable.

8.

Child Related: Include clothing, personal and incidental expenses for the child, school supplies, planned activities and other child-related costs. County clothing allowances will offset

these costs.

9a. Executive Director Salary: Report annual salary for person designated as the Executive Director, Include payroll, payroll taxes, and benefits (if applicable).

9b. Assistant Director Salary: Report annual salary for person(s) designated as the Assistant Executive Director. Include payroll, payroll taxes, and benefits (if applicable).

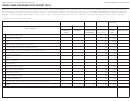

1

1 2

2 3

3