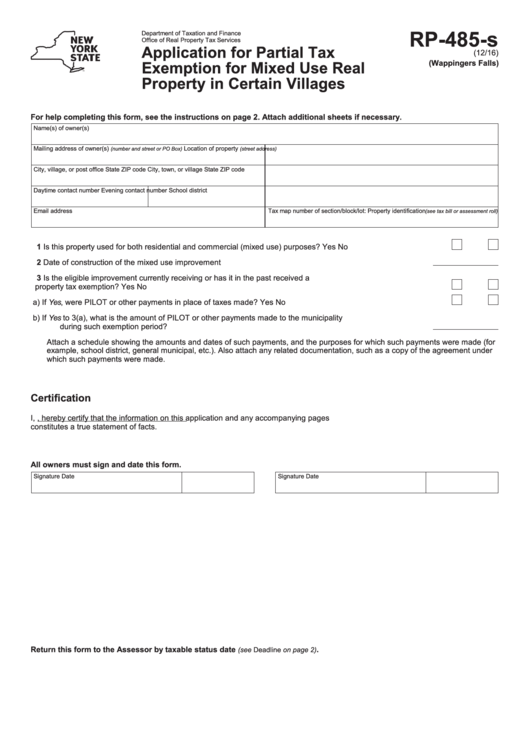

RP-485-s

Department of Taxation and Finance

Office of Real Property Tax Services

Application for Partial Tax

(12/16)

Exemption for Mixed Use Real

(Wappingers Falls)

Property in Certain Villages

For help completing this form, see the instructions on page 2. Attach additional sheets if necessary.

Name(s) of owner(s)

Mailing address of owner(s)

Location of property

(number and street or PO Box)

(street address)

City, village, or post office

State

ZIP code

City, town, or village

State

ZIP code

Daytime contact number

Evening contact number

School district

Email address

Tax map number of section/block/lot: Property identification

(see tax bill or assessment roll)

1 Is this property used for both residential and commercial (mixed use) purposes? ................................................. Yes

No

2 Date of construction of the mixed use improvement ..............................................................................................

3 Is the eligible improvement currently receiving or has it in the past received a

property tax exemption? .......................................................................................................................................... Yes

No

a) If Yes, were PILOT or other payments in place of taxes made? ....................................................................... Yes

No

b) If Yes to 3(a), what is the amount of PILOT or other payments made to the municipality

during such exemption period? ........................................................................................................................

Attach a schedule showing the amounts and dates of such payments, and the purposes for which such payments were made (for

example, school district, general municipal, etc.). Also attach any related documentation, such as a copy of the agreement under

which such payments were made.

Certification

I,

, hereby certify that the information on this application and any accompanying pages

constitutes a true statement of facts.

All owners must sign and date this form.

Signature

Date

Signature

Date

Return this form to the Assessor by taxable status date

.

(see Deadline on page 2)

1

1 2

2