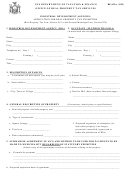

RP-480-a (1/95)

2

GENERAL INFORMATION AND FILING REQUIREMENTS

1. Place of filing

Application and certified copy of a duly filed commitment (and copies of other required papers) must be filed with

the city, town or village assessor. If the property is located in a village which assesses, such papers must be filed with both

the town assessor and the village assessor. In Nassau and Tompkins Counties, these papers should be filed with the county

assessor.

2. Time of filing

The application for exemption must be filed prior to the taxable status date of the city, town or village and, if

approved, the exemption will initially appear on the first assessment roll prepared subsequent to the taxable status date.

Since taxable status date differs among municipalities, the appropriate assessor’s office should be consulted. To continue

receiving the exemption in subsequent years, the owner must file a certified copy of the duly filed annual commitment of

such tract to continued forest crop production for the next succeeding ten tears under the approved management plan, with

the appropriate assessor prior to the appropriate taxable status date. Following a failure to file a certified commitment in one

or more years, in order to obtain a forest land exemption under RPTL, Sec. 480-a, an owner of a certified tract may submit a

certified commitment to the assessor before the taxable status date in any subsequent year except that if more than five years

has elapsed since the last annual commitment was made, a new application for exemption shall be necessary. A new

application shall also be required whenever, during the preceding year, the approved management plan has been amended

with respect to the acreage or portion of forest land committed to forest crop production under RPTL, Sec. 480-a.

3. Description of land

The tract of forest land must comprise at least 50 contiguous acres, exclusive of any portion thereof not devoted to

the production of forest crops. It is sufficient to enter the assessment roll description (s) or the tax map land parcel number

(s). If the forest land exemption is sought for only a portion of any single parcel on the assessment roll, then the applicant

should supply a sketch of such portion indicating the number of acres therein. (An accurate description of the tract or portion

thereof for which exemption is sought is important, because a conversion of any portion of land granted exempt status will

result in the revocation of the certificate of approval for the whole tract and the imposition of severe penalties.)

4. Filing requirement information

A certificate of approval issued for an eligible tract by the Department of Environmental Conservation and the filing

of the certificate with the county clerk are essential prerequisites of filing an application for a forest land exemption with the

assessor. Revocation of a certificate of approval will occur upon payment of appropriate penalties following the conversion

of the property or after nine years have passed from the year of the last commitment filed with the assessor. After the initial

application is approved by the assessor, only a certified copy of the annual commitment must be filed with the assessor.

Application for such commitment shall be made by the owner of such tract to the Department of Environmental Conservation

and the commitment shall be certified by the Department. Failure to make an annual commitment and filing a certified copy

thereof with the assessor prior to the appropriate taxable status date annually will result in the termination of the exemption

for that and succeeding years for which no commitments are made.

SPACE BELOW FOR USE OF ASSESSOR

Date application filed: _____________________________

Applicable status date: __________________________

Submitted:

Copy of type map

Certified copy of commitment

Application approved

Application disapproved

Certificate of approval number _________________

Exemption computed on the basis of 80% of assessed valuation

Exemption computed on the basis of $40 per acre equalized

Exemption applies to taxes levied by: ___________________________________________

(County/City/Town/Village/School District)

__________________________________________

__________________________________________

_____________________

__________________________________________________

Date

Assessor’s signature

1

1 2

2