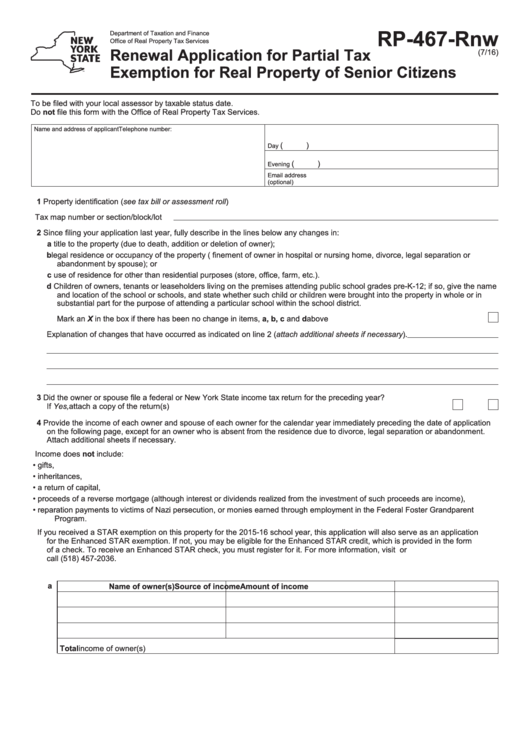

RP-467-Rnw

Department of Taxation and Finance

Office of Real Property Tax Services

Renewal Application for Partial Tax

(7/16)

Exemption for Real Property of Senior Citizens

To be filed with your local assessor by taxable status date.

Do not file this form with the Office of Real Property Tax Services.

Name and address of applicant

Telephone number:

(

)

Day

(

)

Evening

Email address

(optional)

1 Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot

2 Since filing your application last year, fully describe in the lines below any changes in:

a title to the property (due to death, addition or deletion of owner);

b legal residence or occupancy of the property (e.g. confinement of owner in hospital or nursing home, divorce, legal separation or

abandonment by spouse); or

c use of residence for other than residential purposes (store, office, farm, etc.).

d Children of owners, tenants or leaseholders living on the premises attending public school grades pre-K-12; if so, give the name

and location of the school or schools, and state whether such child or children were brought into the property in whole or in

substantial part for the purpose of attending a particular school within the school district.

Mark an X in the box if there has been no change in items, a, b, c and d above ......................................................................

Explanation of changes that have occurred as indicated on line 2 (attach additional sheets if necessary).

3 Did the owner or spouse file a federal or New York State income tax return for the preceding year?

If Yes, attach a copy of the return(s) ...................................................................................................................... Yes

No

4 Provide the income of each owner and spouse of each owner for the calendar year immediately preceding the date of application

on the following page, except for an owner who is absent from the residence due to divorce, legal separation or abandonment.

Attach additional sheets if necessary.

Income does not include:

• gifts,

• inheritances,

• a return of capital,

• proceeds of a reverse mortgage (although interest or dividends realized from the investment of such proceeds are income),

• reparation payments to victims of Nazi persecution, or monies earned through employment in the Federal Foster Grandparent

Program.

If you received a STAR exemption on this property for the 2015-16 school year, this application will also serve as an application

for the Enhanced STAR exemption. If not, you may be eligible for the Enhanced STAR credit, which is provided in the form

of a check. To receive an Enhanced STAR check, you must register for it. For more information, visit or

call (518) 457-2036.

a

Name of owner(s)

Source of income

Amount of income

Total income of owner(s) ................................................................................................................

1

1 2

2