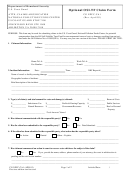

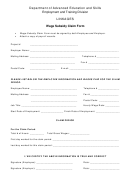

Part 4

When to claim State Pension

You will normally be paid from the date you reached State Pension age (we call this your date of entitlement).

Any money that you earn will not affect your State Pension.

Notes

– We can accept your claim if it is received no earlier than 4

– You will normally need at least 10 qualifying years on

months before the date you wish to get State Pension, or

your National Insurance record to get any State Pension.

the date you reach State Pension age whichever is the later.

– How much State Pension you get will usually be based

– If you put off claiming your State Pension, you can get

on your own NI record only. However, there will still be

extra State Pension.

a few circumstances in which people get some

State Pension through their late husband, wife or civil

– The minimum period you must put off claiming your

partner. So the amount you get could also be based on

State Pension to get extra State Pension is 9 weeks. When

any NI your late husband, wife or civil partner has paid

you do claim you will get a higher weekly State Pension for

or been credited with.

the rest of your life.

– Your UK State Pension will be based on your own UK NI

– Your State Pension cannot be backdated more than 12

record. However, you may be able to use your time

months before the date your claim is received. If you

abroad to make up the 10 qualifying years needed to

backdate your claim this will affect any extra State Pension

get any new State Pension. This is most likely if you’ve

you could get.

lived or worked in:

the European Economic Area (EEA)

– You can find out more about new State Pension by visiting

Switzerland

certain countries that have a social security

agreement with the UK.

11

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26