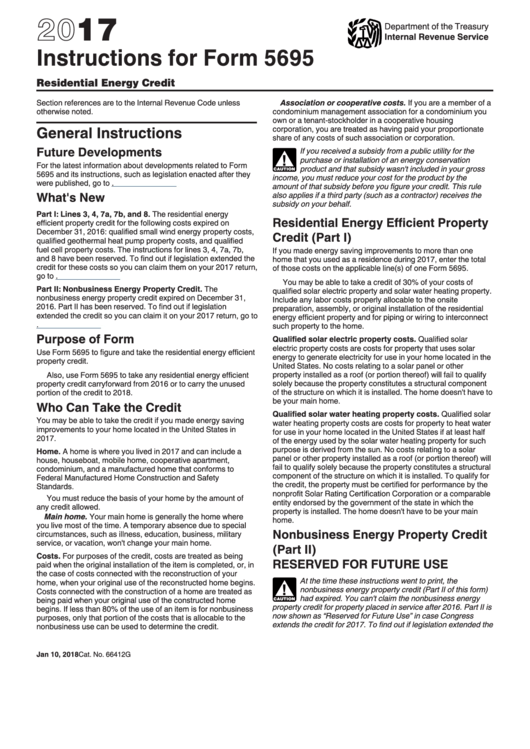

Instructions For Form 5695 - Residential Energy Credit - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 5695

Residential Energy Credit

Section references are to the Internal Revenue Code unless

Association or cooperative costs. If you are a member of a

otherwise noted.

condominium management association for a condominium you

own or a tenant-stockholder in a cooperative housing

General Instructions

corporation, you are treated as having paid your proportionate

share of any costs of such association or corporation.

Future Developments

If you received a subsidy from a public utility for the

purchase or installation of an energy conservation

!

For the latest information about developments related to Form

product and that subsidy wasn't included in your gross

5695 and its instructions, such as legislation enacted after they

CAUTION

income, you must reduce your cost for the product by the

were published, go to IRS.gov/Form5695.

amount of that subsidy before you figure your credit. This rule

What's New

also applies if a third party (such as a contractor) receives the

subsidy on your behalf.

Part I: Lines 3, 4, 7a, 7b, and 8. The residential energy

Residential Energy Efficient Property

efficient property credit for the following costs expired on

December 31, 2016: qualified small wind energy property costs,

Credit (Part I)

qualified geothermal heat pump property costs, and qualified

fuel cell property costs. The instructions for lines 3, 4, 7a, 7b,

If you made energy saving improvements to more than one

and 8 have been reserved. To find out if legislation extended the

home that you used as a residence during 2017, enter the total

credit for these costs so you can claim them on your 2017 return,

of those costs on the applicable line(s) of one Form 5695.

go to IRS.gov/Extenders.

You may be able to take a credit of 30% of your costs of

Part II: Nonbusiness Energy Property Credit. The

qualified solar electric property and solar water heating property.

nonbusiness energy property credit expired on December 31,

Include any labor costs properly allocable to the onsite

2016. Part II has been reserved. To find out if legislation

preparation, assembly, or original installation of the residential

extended the credit so you can claim it on your 2017 return, go to

energy efficient property and for piping or wiring to interconnect

IRS.gov/Extenders.

such property to the home.

Purpose of Form

Qualified solar electric property costs. Qualified solar

electric property costs are costs for property that uses solar

Use Form 5695 to figure and take the residential energy efficient

energy to generate electricity for use in your home located in the

property credit.

United States. No costs relating to a solar panel or other

property installed as a roof (or portion thereof) will fail to qualify

Also, use Form 5695 to take any residential energy efficient

solely because the property constitutes a structural component

property credit carryforward from 2016 or to carry the unused

portion of the credit to 2018.

of the structure on which it is installed. The home doesn't have to

be your main home.

Who Can Take the Credit

Qualified solar water heating property costs. Qualified solar

You may be able to take the credit if you made energy saving

water heating property costs are costs for property to heat water

improvements to your home located in the United States in

for use in your home located in the United States if at least half

2017.

of the energy used by the solar water heating property for such

purpose is derived from the sun. No costs relating to a solar

Home. A home is where you lived in 2017 and can include a

panel or other property installed as a roof (or portion thereof) will

house, houseboat, mobile home, cooperative apartment,

fail to qualify solely because the property constitutes a structural

condominium, and a manufactured home that conforms to

component of the structure on which it is installed. To qualify for

Federal Manufactured Home Construction and Safety

the credit, the property must be certified for performance by the

Standards.

nonprofit Solar Rating Certification Corporation or a comparable

You must reduce the basis of your home by the amount of

entity endorsed by the government of the state in which the

any credit allowed.

property is installed. The home doesn't have to be your main

Main home. Your main home is generally the home where

home.

you live most of the time. A temporary absence due to special

Nonbusiness Energy Property Credit

circumstances, such as illness, education, business, military

service, or vacation, won't change your main home.

(Part II)

Costs. For purposes of the credit, costs are treated as being

RESERVED FOR FUTURE USE

paid when the original installation of the item is completed, or, in

the case of costs connected with the reconstruction of your

At the time these instructions went to print, the

home, when your original use of the reconstructed home begins.

nonbusiness energy property credit (Part II of this form)

!

Costs connected with the construction of a home are treated as

had expired. You can't claim the nonbusiness energy

being paid when your original use of the constructed home

CAUTION

property credit for property placed in service after 2016. Part II is

begins. If less than 80% of the use of an item is for nonbusiness

now shown as “Reserved for Future Use” in case Congress

purposes, only that portion of the costs that is allocable to the

extends the credit for 2017. To find out if legislation extended the

nonbusiness use can be used to determine the credit.

Jan 10, 2018

Cat. No. 66412G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2