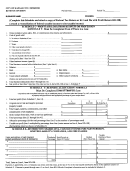

Instructions For Schedule C - Profit Or Loss From Business - 2017 Page 16

ADVERTISEMENT

this purpose and for more information

quired to give us the information. We

The time needed to complete and file

about excess farm losses.

need it to ensure that you are complying

Schedule C-EZ (Form 1040) will vary

with these laws and to allow us to figure

depending on individual circumstances.

Film and television and live theatrical

and collect the right amount of tax.

The estimated burden for individual tax-

production expenses. You can elect to

payers filing this form is included in the

deduct costs of certain qualified film and

You are not required to provide the

estimates shown in the instructions for

television productions that commenced

information requested on a form that is

their individual income tax return. The

before 2017. For details, see chapter 7 of

subject to the Paperwork Reduction Act

estimated burden for all other taxpayers

Pub. 535.

unless the form displays a valid OMB

who file this form is approved under

control number. Books or records relat-

Forestation and reforestation costs.

OMB control number 1545-1973 and is

ing to a form or its instructions must be

Reforestation costs are generally capital

shown next.

retained as long as their contents may

expenditures. However, for each quali-

become material in the administration of

fied timber property, you can elect to ex-

Recordkeeping

45 min.

any Internal Revenue law. Generally,

. . . . . . . . . . .

pense up to $10,000 ($5,000 if married

Learning about the law or the

tax returns and return information are

filing separately) of qualifying reforesta-

form

3 min.

. . . . . . . . . . . . . . . . .

confidential, as required by section

tion costs paid or incurred in 2017.

Preparing the form

35 min.

. . . . . . . .

6103.

You can elect to amortize the remain-

Copying, assembling, and sending the

The time needed to complete and file

form to the IRS

20 min.

ing costs over 84 months. For amortiza-

. . . . . . . . . . .

Schedule C (Form 1040) will vary de-

tion that begins in 2017, you must com-

pending on individual circumstances.

plete and attach Form 4562.

If you have comments concerning the

The estimated burden for individual tax-

The amortization election does not

accuracy of these time estimates or sug-

payers filing this form is included in the

apply to trusts, and the expense election

gestions for making this form simpler,

estimates shown in the instructions for

does not apply to estates and trusts. For

we would be happy to hear from you.

their individual income tax return. The

details on reforestation expenses, see

See the instructions for the tax return

estimated burden for all other taxpayers

chapters 7 and 8 of Pub. 535.

with which this form is filed.

who file this form is approved under

OMB control number 1545-1974 and is

Paperwork Reduction Act Notice. We

shown next.

ask for the information on Schedule C

(Form 1040) and Schedule C-EZ (Form

1040) to carry out the Internal Revenue

Recordkeeping

3 hr., 36 min.

. . . . . . . . .

laws of the United States. You are re-

Learning about the law or the

form

1 hr., 19 min.

. . . . . . . . . . . . . . .

Preparing the form

1 hr., 39 min.

. . . . . .

Copying, assembling, and sending

the form to the IRS

34 min.

. . . . . .

C-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18