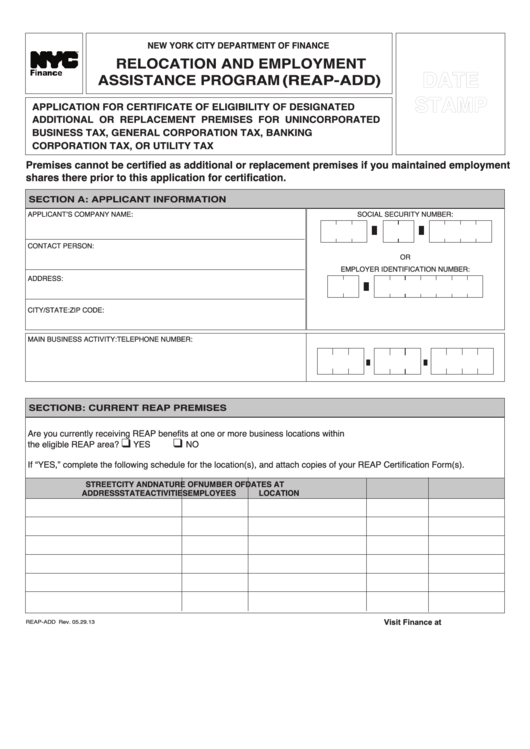

Form Reap-Add - Application For Certificate Of Eligibility Of Designated Additional Or Replacement Premises

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

RELOCATION AND EMPLOYMENT

DATE

ASSISTANCE PROGRAM (REAP-ADD)

STAMP

APPLICATION FOR CERTIFICATE OF ELIGIBILITY OF DESIGNATED

ADDITIONAL OR REPLACEMENT PREMISES FOR UNINCORPORATED

BUSINESS

TAX,

GENERAL

CORPORATION

TAX,

BANKING

CORPORATION TAX, OR UTILITY TAX

Premises cannot be certified as additional or replacement premises if you maintained employment

shares there prior to this application for certification.

SECTION A: APPLICANT INFORMATION

APPLICANT’S COMPANY NAME:

SOCIAL SECURITY NUMBER:

CONTACT PERSON:

OR

EMPLOYER IDENTIFICATION NUMBER:

ADDRESS:

CITY/STATE:

ZIP CODE:

MAIN BUSINESS ACTIVITY:

TELEPHONE NUMBER:

SECTION B: CURRENT REAP PREMISES

Are you currently receiving REAP benefits at one or more business locations within

q

q

the eligible REAP area? ...........................................................................................................................

YES

NO

If “YES,” complete the following schedule for the location(s), and attach copies of your REAP Certification Form(s).

STREET

CITY AND

NATURE OF

NUMBER OF

DATES AT

ADDRESS

STATE

ACTIVITIES

EMPLOYEES

LOCATION

Visit Finance at nyc.gov/finance

REAP-ADD Rev. 05.29.13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3