Lien Sale Property Exemption Application - New York City Department Of Finance

ADVERTISEMENT

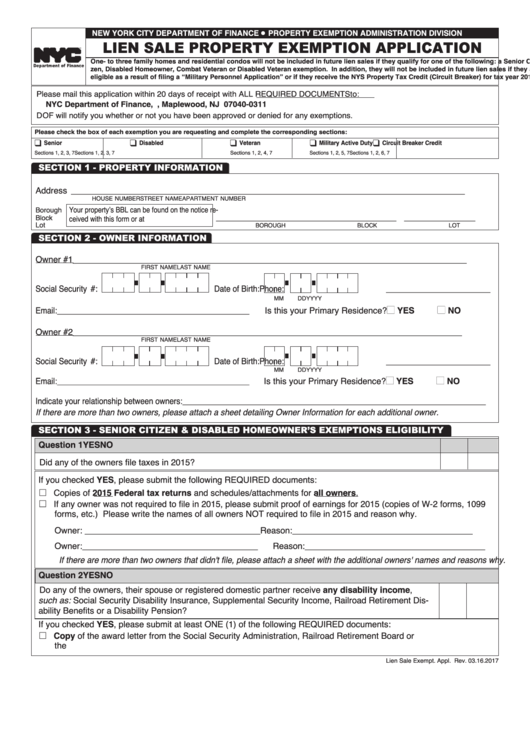

NEW YORK CITY DEPARTMENT OF FINANCE

PROPERTY EXEMPTION ADMINISTRATION DIVISION

LIEN SALE PROPERTY EXEMPTION APPLICATION

l

One- to three family homes and residential condos will not be included in future lien sales if they qualify for one of the following: a Senior Citi-

zen, Disabled Homeowner, Combat Veteran or Disabled Veteran exemption. In addition, they will not be included in future lien sales if they are

eligible as a result of filing a “Military Personnel Application” or if they receive the NYS Property Tax Credit (Circuit Breaker) for tax year 2016.

Please mail this application within 20 days of receipt with ALL REQUIRED DOCUMENTS to:

NYC Department of Finance, P.O. Box 311, Maplewood, NJ 07040-0311

DOF will notify you whether or not you have been approved or denied for any exemptions.

Please check the box of each exemption you are requesting and complete the corresponding sections:

q

q

q

q

q

Senior

Disabled

Veteran

Military Active Duty

Circuit Breaker Credit

Sections 1, 2, 3, 7

Sections 1, 2, 3, 7

Sections 1, 2, 4, 7

Sections 1, 2, 5, 7

Sections 1, 2, 6, 7

SECTION 1 - PROPERTY INFORMATION

Address _________________ ___________________________________________________

_______________

HOUSE NUMBER

STREET NAME

APARTMENT NUMBER

Your property’s BBL can be found on the notice re-

Borough

_____________________

_________________ _______________

ceived with this form or at

Block

Lot

BOROUGH

BLOCK

LOT

SECTION 2 - OWNER INFORMATION

Owner #1 _______________________________________

____________________________________________

FIRST NAME

LAST NAME

Social Security #:

Date of Birth:

Phone:______________________

MM

DD

YYYY

YES

NO

Email:_____________________________________________

Is this your Primary Residence?

n

n

Owner #2 ______________________________________

____________________________________________

FIRST NAME

LAST NAME

Social Security #:

Date of Birth:

Phone:______________________

MM

DD

YYYY

YES

NO

Email:_____________________________________________

Is this your Primary Residence?

n

n

Indicate your relationship between owners:_______________________________________________________________________

If there are more than two owners, please attach a sheet detailing Owner Information for each additional owner.

SECTION 3 - SENIOR CITIZEN & DISABLED HOMEOWNER’S EXEMPTIONS ELIGIBILITY

Question 1

YES

NO

Did any of the owners file taxes in 2015?

If you checked YES, please submit the following REQUIRED documents:

□ Copies of 2015 Federal tax returns and schedules/attachments for all owners.

□ If any owner was not required to file in 2015, please submit proof of earnings for 2015 (copies of W-2 forms, 1099

forms, etc.) Please write the names of all owners NOT required to file in 2015 and reason why.

Owner: _____________________________________

Reason:______________________________________

Owner:_____________________________________

Reason:______________________________________

If there are more than two owners that didn't file, please attach a sheet with the additional owners' names and reasons why.

Question 2

YES

NO

Do any of the owners, their spouse or registered domestic partner receive any disability income,

such as: Social Security Disability Insurance, Supplemental Security Income, Railroad Retirement Dis-

ability Benefits or a Disability Pension?

If you checked YES, please submit at least ONE (1) of the following REQUIRED documents:

□ Copy of the award letter from the Social Security Administration, Railroad Retirement Board or

the U.S. Postal Service OR the State Commission for the Blind and Visually Handicapped

Lien Sale Exempt. Appl. Rev. 03.16.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2