*171861*

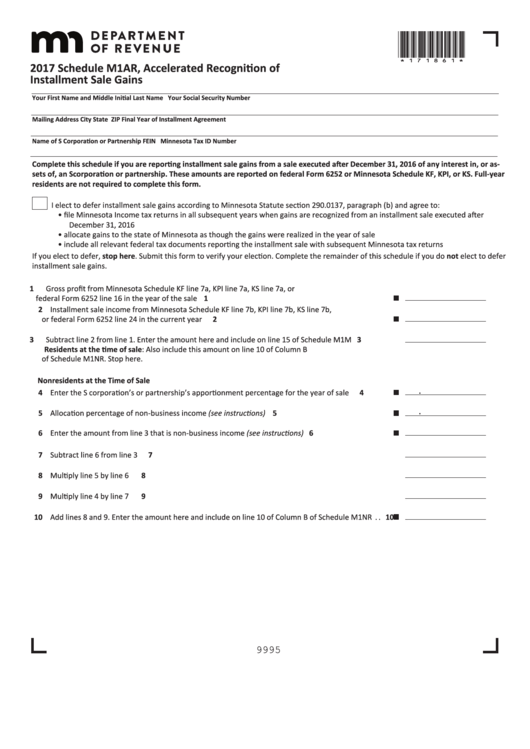

2017 Schedule M1AR, Accelerated Recognition of

Installment Sale Gains

Your First Name and Middle Initial

Last Name

Your Social Security Number

Mailing Address

City

State

ZIP

Final Year of Installment Agreement

Name of S Corporation or Partnership

FEIN

Minnesota Tax ID Number

Complete this schedule if you are reporting installment sale gains from a sale executed after December 31, 2016 of any interest in, or as-

sets of, an Scorporation or partnership. These amounts are reported on federal Form 6252 or Minnesota Schedule KF, KPI, or KS. Full-year

residents are not required to complete this form.

I elect to defer installment sale gains according to Minnesota Statute section 290.0137, paragraph (b) and agree to:

• file Minnesota Income tax returns in all subsequent years when gains are recognized from an installment sale executed after

December 31, 2016

• allocate gains to the state of Minnesota as though the gains were realized in the year of sale

• include all relevant federal tax documents reporting the installment sale with subsequent Minnesota tax returns

If you elect to defer, stop here. Submit this form to verify your election. Complete the remainder of this schedule if you do not elect to defer

installment sale gains.

1 Gross profit from Minnesota Schedule KF line 7a, KPI line 7a, KS line 7a, or

federal Form 6252 line 16 in the year of the sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Installment sale income from Minnesota Schedule KF line 7b, KPI line 7b, KS line 7b,

2

or federal Form 6252 line 24 in the current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Subtract line 2 from line 1. Enter the amount here and include on line 15 of Schedule M1M. . . . . . .

3

Residents at the time of sale: Also include this amount on line 10 of Column B

of Schedule M1NR. Stop here.

Nonresidents at the Time of Sale

.

4 Enter the S corporation’s or partnership’s apportionment percentage for the year of sale . . . . . . . .

4

.

5 Allocation percentage of non-business income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Enter the amount from line 3 that is non-business income (see instructions) . . . . . . . . . . . . . . . . . . . .

6

7 Subtract line 6 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Multiply line 5 by line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Multiply line 4 by line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Add lines 8 and 9. Enter the amount here and include on line 10 of Column B of Schedule M1NR . . 10

9995

1

1 2

2