Form ETD Instructions

Promoter’s Responsibility

To pay electronically, go to

Residents of Michigan and

state.mn.us and log into e-Services. If you

North Dakota

Withholding Requirements. Promoters

are not required to pay electronically, make

Minnesota has income tax reciprocity

and organizations who pay nonresident

check payable to: Minnesota Revenue.

agreements with Michigan and North

entertainers to perform in Minnesota must

Dakota.

withhold 2 percent of the entertainer’s

Information and Assistance

gross compensation and deposit it with the

Compensation paid to entertainers who

department using Form ETD.

Additional forms and information, includ-

are residents of Michigan or North Dakota

ing fact sheets and frequently asked ques-

is not subject to nonresident entertainer

The deposit and Form ETD are due the last

tions, are available on our website.

tax. However, the promoter should with-

day of the month following the month of

hold nonresident entertainer tax from the

the performance.

Website: state.mn.us

compensation unless they receive a prop-

Email: withholding.tax@state.mn.us

Gross compensation includes reimburse-

erly completed Form MWR, Reciprocity

ments made to the entertainer for transpor-

Phone: 651-282 9999 or 1-800-657-3594

Exemption/Affidavit of Residency, from the

tation, lodging and other expenses.

entertainer.

This information is available in alternate

Exceptions. Promoters are not required to

formats.

Register for Nonresident Entertainer

withhold the 2 percent nonresident enter-

Tax

tainer tax from the compensation if any of

If you are not registered for nonresident

the following apply:

Use of Information

entertainer tax, you must add this tax type

All information on this form is private

• The payments made to a nonresident

to your current Minnesota tax ID number.

by state law. It cannot be given to others

public speaker are less than $2,000

To update your business information, go to

without your permission, except to the

• The payments made to a nonresident

our website at state.mn.us, or

Internal Revenue Service, other states

entertainer or entertainment entity are

call 651-282-9999 or 1-800-657-3594.

that guarantee the same privacy, and

less than $600

certain government agencies as provided

Form ETD Instructions

• The nonresident entertainer or entity is

by law.

a resident of North Dakota or Michigan

At the top

All information requested is required

and the individual provided a properly

Enter the month and year for which you are

by law except your phone number. The

completed Form MWR, Reciprocity

sending a deposit. Submit a separate Form

required information will be used for

Exemption/Affidavit of Residency (see

ETD for each month.

identification and to verify that the cor-

“Residents of Michigan and North Da-

rect amount of tax has been withheld

kota” on this page)

Lines 3 and 4

and paid to Minnesota. We ask for your

See the withholding instruction booklet,

Filing Requirements. Give a Form 1099-

phone number so we can contact you

Minnesota Income Tax Withholding, for

MISC to each entertainer you paid for per-

quickly if we have questions.

penalty and interest calculations.

formances in Minnesota and were federally

required to pay.

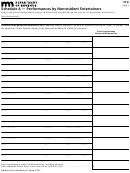

Schedule A Instructions

When completing Form 1099-MISC, enter

Complete Schedule A to report the gross

the total compensation paid to the enter-

compensation subject to Minnesota tax paid

tainer in box 7 (nonemployee compensa-

during the month to nonresident entertain-

tion). Write “MN” in box 17 (state) and the

ers. Attach the completed Schedule A when

amount of entertainer tax withheld in box

you file Form ETD.

16. Write “Nonresident entertainer tax” in

box 15b.

Depositing Requirements

At the end of the year, file Form ETA, Pro-

Deposits must be made electronically if

moter’s Annual Reconciliation, and attach

either of the following apply:

copies of all 1099s issued to entertainers

during the year.

• You are required to electronically pay

any other Minnesota business tax to the

Form ETA and 1099s are due on or before

department

January 31.

• You withheld a total of $10,000 or more

in Minnesota income tax during the last

12-month period ending June 30

1

1 2

2 3

3