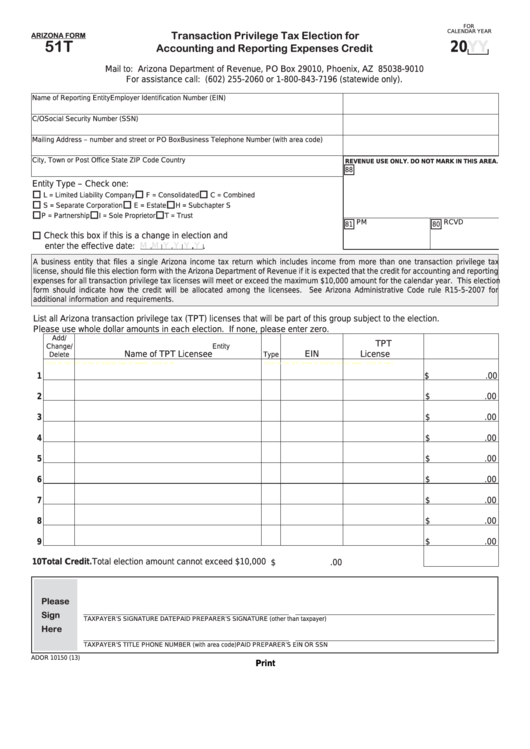

FOR

Transaction Privilege Tax Election for

CALENDAR YEAR

ARIZONA FORM

51T

20YY

Accounting and Reporting Expenses Credit

Mail to: Arizona Department of Revenue, PO Box 29010, Phoenix, AZ 85038-9010

For assistance call: (602) 255-2060 or 1-800-843-7196 (statewide only).

Name of Reporting Entity

Employer Identification Number (EIN)

C/O

Social Security Number (SSN)

Mailing Address – number and street or PO Box

Business Telephone Number (with area code)

City, Town or Post Office

State

ZIP Code

Country

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Entity Type – Check one:

L = Limited Liability Company

F = Consolidated

C = Combined

S = Separate Corporation

E = Estate

H = Subchapter S

P = Partnership

I = Sole Proprietor

T = Trust

81 PM

80 RCVD

Check this box if this is a change in election and

M M Y Y Y Y

enter the effective date:

.

A business entity that files a single Arizona income tax return which includes income from more than one transaction privilege tax

license, should file this election form with the Arizona Department of Revenue if it is expected that the credit for accounting and reporting

expenses for all transaction privilege tax licenses will meet or exceed the maximum $10,000 amount for the calendar year. This election

form should indicate how the credit will be allocated among the licensees. See Arizona Administrative Code rule R15-5-2007 for

additional information and requirements.

List all Arizona transaction privilege tax (TPT) licenses that will be part of this group subject to the election.

Please use whole dollar amounts in each election. If none, please enter zero.

Add/

TPT

Change/

Entity

Name of TPT Licensee

EIN

License No.

Election Amount

Delete

Type

Click on the left arrow to display type of update; click on one to select.

Click on the left arrow to display entity types; click on one to select.

1

$

.00

2

$

.00

3

$

.00

4

$

.00

5

$

.00

6

$

.00

7

$

.00

8

$

.00

9

$

.00

10 Total Credit. Total election amount cannot exceed $10,000 ........................................................... $

.00

Please

Sign

TAXPAYER’S SIGNATURE

DATE

PAID PREPARER’S SIGNATURE (other than taxpayer)

Here

TAXPAYER’S TITLE

PHONE NUMBER (with area code)

PAID PREPARER’S EIN OR SSN

ADOR 10150 (13)

Print

1

1