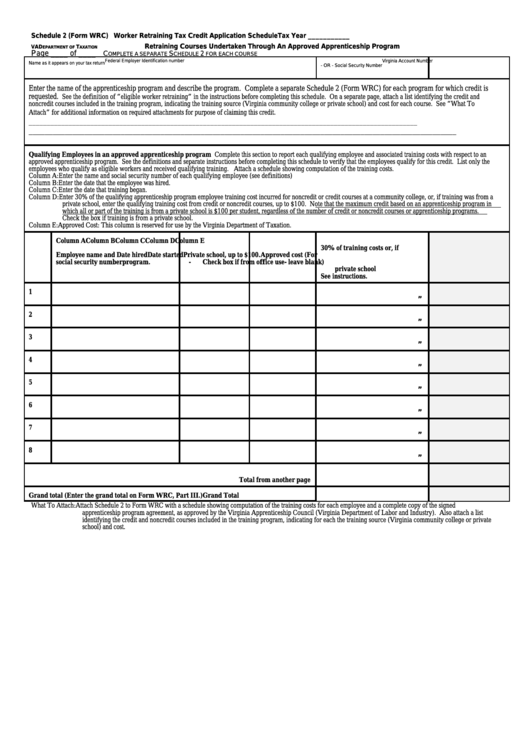

Schedule 2 (Form Wrc) - Worker Retraining Tax Credit Application Schedule

ADVERTISEMENT

Schedule 2 (Form WRC)

Worker Retraining Tax Credit Application Schedule

Tax Year ___________

Retraining Courses Undertaken Through An Approved Apprenticeship Program

VA D

T

EPARTMENT OF

AXATION

Page ____ of ____

C

S

2

OMPLETE A SEPARATE

CHEDULE

FOR EACH COURSE

Federal Employer Identification number

Virginia Account Number

Name as it appears on your tax return

- OR - Social Security Number

Enter the name of the apprenticeship program and describe the program. Complete a separate Schedule 2 (Form WRC) for each program for which credit is

requested.

See the definition of “eligible worker retraining” in the instructions before completing this schedule. On a separate page, attach a list identifying the credit and

noncredit courses included in the training program, indicating the training source (Virginia community college or private school) and cost for each course. See “What To

Attach” for additional information on required attachments for purpose of claiming this credit.

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Qualifying Employees in an approved apprenticeship program Complete this section to report each qualifying employee and associated training costs with respect to an

approved apprenticeship program. See the definitions and separate instructions before completing this schedule to verify that the employees qualify for this credit. List only the

employees who qualify as eligible workers and received qualifying training. Attach a schedule showing computation of the training costs.

Column A: Enter the name and social security number of each qualifying employee (see definitions)

Column B: Enter the date that the employee was hired.

Column C: Enter the date that training began.

Column D: Enter 30% of the qualifying apprenticeship program employee training cost incurred for noncredit or credit courses at a community college, or, if training was from a

private school, enter the qualifying training cost from credit or noncredit courses, up to $100.

Note that the maximum credit based on an apprenticeship program in

which all or part of the training is from a private school is $100 per student, regardless of the number of credit or noncredit courses or apprenticeship programs

.

Check the box if training is from a private school.

Column E: Approved Cost: This column is reserved for use by the Virginia Department of Taxation.

Column A

Column B

Column C

Column D

Column E

30% of training costs or, if

Employee name and

Date hired

Date started

Private school, up to $100.

Approved cost (For

social security number

program.

-

Check box if from

office use- leave blank)

private school

See instructions.

1

”

2

”

3

”

4

”

5

”

6

”

7

”

8

”

Total from another page

Grand total (Enter the grand total on Form WRC, Part III.)

Grand Total

What To Attach: Attach Schedule 2 to Form WRC with a schedule showing computation of the training costs for each employee and a complete copy of the signed

apprenticeship program agreement, as approved by the Virginia Apprenticeship Council (Virginia Department of Labor and Industry). Also attach a list

identifying the credit and noncredit courses included in the training program, indicating for each the training source (Virginia community college or private

school) and cost.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1