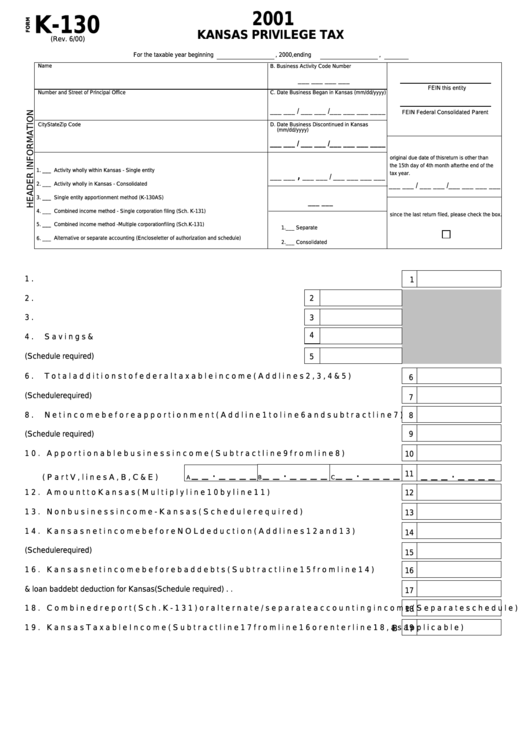

Form K-130 - Kansas Privilege Tax - 2001

ADVERTISEMENT

2001

K-130

KANSAS PRIVILEGE TAX

(Rev. 6/00)

For the taxable year beginning

, 2000, ending

,

Name

B. Business Activity Code Number

___ ___ ___ ___

FEIN this entity

Number and Street of Principal Office

C. Date Business Began in Kansas (mm/dd/yyyy)

___ ___ / ___ ___ /___ ___ ___ ____

FEIN Federal Consolidated Parent

City

State

Zip Code

D. Date Business Discontinued in Kansas

(mm/dd/yyyy)

___ ___ / ___ ___ /___ ___ ___ ____

___ ___ / ___ ___ /___ ___ ___ ____

H. Enter your original federal due date if the

A. Method Used to Determine Income of Corporation in Kansas

original due date of this return is other than

E. State and Month/Year of Incorporation

the 15th day of 4th month after the end of the

1. ___

Activity wholly within Kansas - Single entity

,

tax year.

___ ___

___ ___ / ___ ___ ___ ___

2. ___

Activity wholly in Kansas - Consolidated

___ ___ / ___ ___ /___ ___ ___ ___

F. State of Commercial Domicile

3. ___

Single entity apportionment method (K-130AS)

___ ___

I. If any information in this header has changed

4. ___

Combined income method - Single corporation filing (Sch. K-131)

since the last return filed, please check the box.

G. Type of Federal Return Filed

5. ___

Combined income method - Multiple corporation filing (Sch. K-131)

1. ___ Separate

6. ___

Alternative or separate accounting (Enclose letter of authorization and schedule)

2. ___ Consolidated

1.

Federal taxable income for Kansas privilege tax purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

2.

Total state and municipal interest income . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Federal net operating loss deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

4.

Savings & loan bad debt deduction included in federal deductions . . . . . . .

5.

Other additions to federal taxable income (Schedule required) . . . . . . . . . .

5

6.

Total additions to federal taxable income (Add lines 2, 3, 4 & 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7.

Other subtractions from federal taxable income (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8.

Net income before apportionment (Add line 1 to line 6 and subtract line 7) . . . . . . . . . . . . . . . . . . . . . . .

8

9.

Nonbusiness income - Total company (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Apportionable business income (Subtract line 9 from line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Average percent to Kansas

_ _ . _ _ _ _

_ _ . _ _ _ _

_ _ . _ _ _ _

_ _ _ . _ _ _ _

11

(Part V, lines A, B, C & E) . . . . . . . . . . .

A

B

C

12. Amount to Kansas (Multiply line 10 by line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13. Nonbusiness income - Kansas (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14. Kansas net income before NOL deduction (Add lines 12 and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15. Kansas net operating loss deduction (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16. Kansas net income before bad debts (Subtract line 15 from line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. Savings & loan bad debt deduction for Kansas (Schedule required) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. Combined report (Sch. K-131) or alternate/separate accounting income (Separate schedule) . . . . . . . .

18

19. Kansas Taxable Income (Subtract line 17 from line 16 or enter line 18, as applicable) . . . . . . . . . . . . .

19

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4