85 East 7th Place, Suite 125, St. Paul, MN 55101-2143

Ph: 651-296-7938 • Fax: 651-282-2644 • boa.state.mn.us

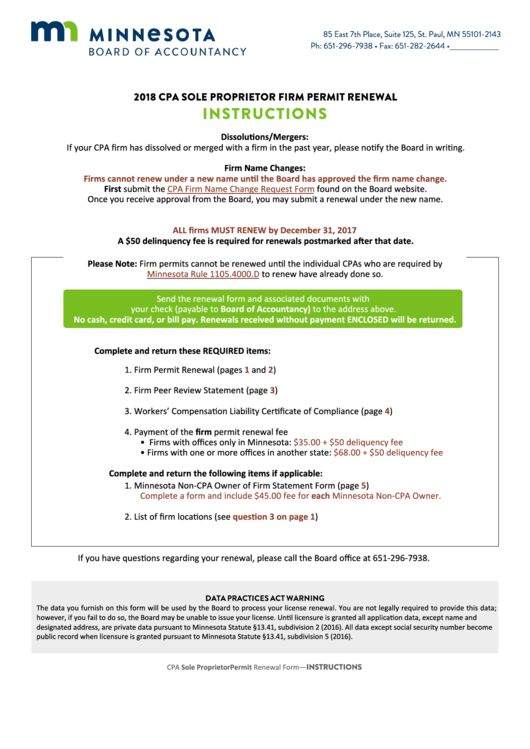

2018 CPA SOLE PROPRIETOR FIRM PERMIT RENEWAL

INSTRUCTIONS

Dissolutions/Mergers:

If your CPA firm has dissolved or merged with a firm in the past year, please notify the Board in writing.

Firm Name Changes:

Firms cannot renew under a new name until the Board has approved the firm name change.

First submit the

CPA Firm Name Change Request Form

found on the Board website.

Once you receive approval from the Board, you may submit a renewal under the new name.

ALL firms MUST RENEW by December 31, 2017

A $50 delinquency fee is required for renewals postmarked after that date.

Please Note: Firm permits cannot be renewed until the individual CPAs who are required by

Minnesota Rule 1105.4000.D

to renew have already done so.

Send the renewal form and associated documents with

your check (payable to Board of Accountancy) to the address above.

No cash, credit card, or bill pay. Renewals received without payment ENCLOSED will be returned.

Complete and return these REQUIRED items:

1. Firm Permit Renewal (pages

1

and 2)

2. Firm Peer Review Statement (page 3)

3. Workers’ Compensation Liability Certificate of Compliance (page 4)

4. Payment of the firm permit renewal fee

•

Firms with offices only in Minnesota:

$35.00 + $50 deliquency fee

•

Firms with one or more offices in another state:

$68.00 + $50 deliquency fee

Complete and return the following items if applicable:

1. Minnesota Non-CPA Owner of Firm Statement Form (page 5)

Complete a form and include $45.00 fee for each Minnesota Non-CPA Owner.

question 3 on page

1)

2. List of firm locations (see

If you have questions regarding your renewal, please call the Board office at 651-296-7938.

DATA PRACTICES ACT WARNING

The data you furnish on this form will be used by the Board to process your license renewal. You are not legally required to provide this data;

however, if you fail to do so, the Board may be unable to issue your license. Until licensure is granted all application data, except name and

designated address, are private data pursuant to Minnesota Statute §13.41, subdivision 2 (2016). All data except social security number become

public record when licensure is granted pursuant to Minnesota Statute §13.41, subdivision 5 (2016).

CPA Sole Proprietor Permit Renewal Form—INSTRUCTIONS

1

1 2

2 3

3 4

4 5

5 6

6