85 East 7th Place, Suite 125, St. Paul, MN 55101-2143

Ph: 651-296-7938 • Fax: 651-282-2644 • boa.state.mn.us

B O A R D O F A C C O U N T A N C Y

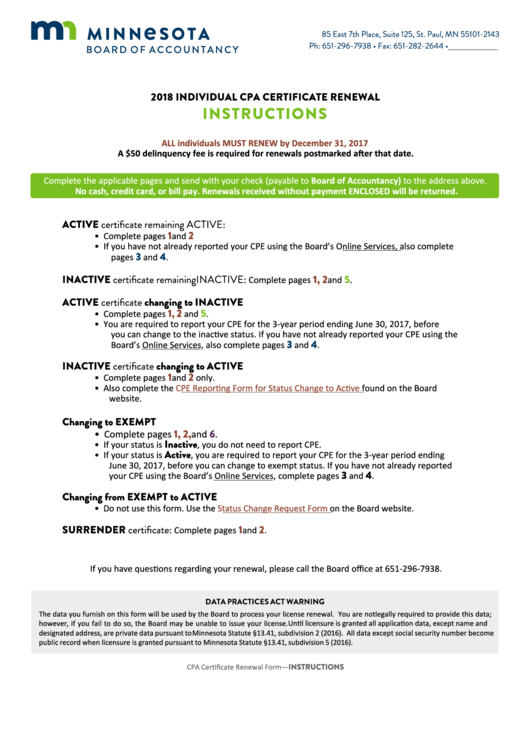

2018 INDIVIDUAL CPA CERTIFICATE RENEWAL

INSTRUCTIONS

ALL individuals MUST RENEW by December 31, 2017

A $50 delinquency fee is required for renewals postmarked after that date.

Complete the applicable pages and send with your check (payable to Board of Accountancy) to the address above.

No cash, credit card, or bill pay. Renewals received without payment ENCLOSED will be returned.

ACTIVE certificate remaining ACTIVE:

1

2

•

Complete pages

and

•

If you have not already reported your CPE using the Board’s Online Services, also complete

3

4

pages

and

.

INACTIVE certificate remaining INACTIVE:

1, 2

5.

Complete pages

and

ACTIVE certificate changing to INACTIVE

1

2

5

,

•

Complete pages

and

.

•

You are required to report your CPE for the 3-year period ending June 30, 2017, before

you can change to the inactive status. If you have not already reported your CPE using the

3

4

Board’s Online Services, also complete pages

and

.

INACTIVE certificate changing to ACTIVE

1

2

•

Complete pages

and

only.

•

Also complete the

CPE Reporting Form for Status Change to Active

found on the Board

website.

Changing to EXEMPT

1, 2,

and 6.

• Complete pages

Inactive

•

If your status is

, you do not need to report CPE.

Active

•

If your status is

, you are required to report your CPE for the 3-year period ending

June 30, 2017, before you can change to exempt status. If you have not already reported

3

4

your CPE using the Board’s Online Services, complete pages

and

.

Changing from EXEMPT to ACTIVE

•

Do not use this form. Use the

Status Change Request Form

on the Board website.

SURRENDER certificate:

1

2

Complete pages

and

.

If you have questions regarding your renewal, please call the Board office at 651-296-7938.

DATA PRACTICES ACT WARNING

The data you furnish on this form will be used by the Board to process your license renewal. You are not legally required to provide this data;

however, if you fail to do so, the Board may be unable to issue your license. Until licensure is granted all application data, except name and

designated address, are private data pursuant to Minnesota Statute §13.41, subdivision 2 (2016). All data except social security number become

public record when licensure is granted pursuant to Minnesota Statute §13.41, subdivision 5 (2016).

CPA Certificate Renewal Form—INSTRUCTIONS

1

1 2

2 3

3 4

4 5

5 6

6 7

7