Print

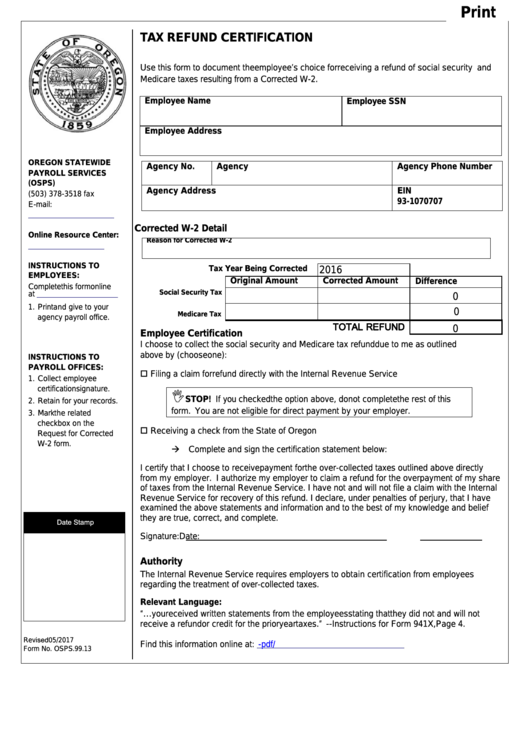

TAX REFUND CERTIFICATION

Use this form to document the employee’s choice for receiving a refund of social security and

Medicare taxes resulting from a Corrected W-2.

Employee Name

Employee SSN

Employee Address

OREGON STATEWIDE

Agency No.

Agency

Agency Phone Number

PAYROLL SERVICES

(OSPS)

Agency Address

EIN

(503) 378-3518 fax

93-1070707

E-mail:

OSPS.Help@oregon.gov

Corrected W-2 Detail

Online Resource Center:

Reason for Corrected W-2

INSTRUCTIONS TO

Tax Year Being Corrected

2016

EMPLOYEES:

Original Amount

Corrected Amount

Difference

Complete this form online

Social Security Tax

at

0

1. Print and give to your

0

Medicare Tax

agency payroll office.

TOTAL REFUND

0

Employee Certification

I choose to collect the social security and Medicare tax refund due to me as outlined

above by (choose one):

INSTRUCTIONS TO

PAYROLL OFFICES:

Filing a claim for refund directly with the Internal Revenue Service

1. Collect employee

certification signature.

STOP! If you checked the option above, do not complete the rest of this

2. Retain for your records.

form. You are not eligible for direct payment by your employer.

3. Mark the related

checkbox on the

Receiving a check from the State of Oregon

Request for Corrected

W-2 form.

Complete and sign the certification statement below:

I certify that I choose to receive payment for the over-collected taxes outlined above directly

from my employer. I authorize my employer to claim a refund for the overpayment of my share

of taxes from the Internal Revenue Service. I have not and will not file a claim with the Internal

Revenue Service for recovery of this refund. I declare, under penalties of perjury, that I have

examined the above statements and information and to the best of my knowledge and belief

they are true, correct, and complete.

Date Stamp

Signature:

Date:

Authority

The Internal Revenue Service requires employers to obtain certification from employees

regarding the treatment of over-collected taxes.

Relevant Language:

“…you received written statements from the employees stating that they did not and will not

receive a refund or credit for the prior year taxes.” -- Instructions for Form 941X, Page 4.

Revised 05/2017

Find this information online at:

Form No. OSPS.99.13

1

1