Form St-4 - Sales Tax Resale Certificate

ADVERTISEMENT

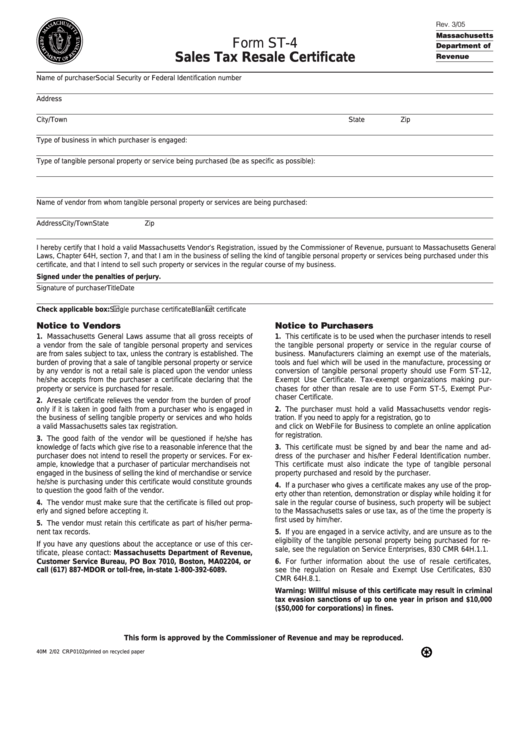

Rev. 3/05

Massachusetts

Form ST-4

Department of

Sales Tax Resale Certificate

Revenue

Name of purchaser

Social Security or Federal Identification number

Address

City/Town

State

Zip

Type of business in which purchaser is engaged:

Type of tangible personal property or service being purchased (be as specific as possible):

Name of vendor from whom tangible personal property or services are being purchased:

Address

City/Town

State

Zip

I hereby certify that I hold a valid Massachusetts Vendor’s Registration, issued by the Commissioner of Revenue, pursuant to Massachusetts General

Laws, Chapter 64H, section 7, and that I am in the business of selling the kind of tangible personal property or services being purchased under this

certificate, and that I intend to sell such property or services in the regular course of my business.

Signed under the penalties of perjury.

Signature of purchaser

Title

Date

Check applicable box:

Single purchase certificate

Blanket certificate

Notice to Vendors

Notice to Purchasers

1. Massachusetts General Laws assume that all gross receipts of

1. This certificate is to be used when the purchaser intends to resell

a vendor from the sale of tangible personal property and services

the tangible personal property or service in the regular course of

are from sales subject to tax, unless the contrary is established. The

business. Manufacturers claiming an exempt use of the materials,

burden of proving that a sale of tangible personal property or service

tools and fuel which will be used in the manufacture, processing or

by any vendor is not a retail sale is placed upon the vendor unless

conversion of tangible personal property should use Form ST-12,

he/she accepts from the purchaser a certificate declaring that the

Exempt Use Certificate. Tax-exempt organizations making pur-

property or service is purchased for resale.

chases for other than resale are to use Form ST-5, Exempt Pur-

chaser Certificate.

2. A resale certificate relieves the vendor from the burden of proof

only if it is taken in good faith from a purchaser who is engaged in

2. The purchaser must hold a valid Massachusetts vendor regis-

the business of selling tangible property or services and who holds

tration. If you need to apply for a registration, go to

a valid Massachusetts sales tax registration.

and click on WebFile for Business to complete an online application

for registration.

3. The good faith of the vendor will be questioned if he/she has

knowledge of facts which give rise to a reasonable inference that the

3. This certificate must be signed by and bear the name and ad-

purchaser does not intend to resell the property or services. For ex-

dress of the purchaser and his/her Federal Identification number.

ample, knowledge that a purchaser of particular merchandise is not

This certificate must also indicate the type of tangible personal

engaged in the business of selling the kind of merchandise or service

property purchased and resold by the purchaser.

he/she is purchasing under this certificate would constitute grounds

4. If a purchaser who gives a certificate makes any use of the prop-

to question the good faith of the vendor.

erty other than retention, demonstration or display while holding it for

4. The vendor must make sure that the certificate is filled out prop-

sale in the regular course of business, such property will be subject

erly and signed before accepting it.

to the Massachusetts sales or use tax, as of the time the property is

first used by him/her.

5. The vendor must retain this certificate as part of his/her perma-

nent tax records.

5. If you are engaged in a service activity, and are unsure as to the

eligibility of the tangible personal property being purchased for re-

If you have any questions about the acceptance or use of this cer-

sale, see the regulation on Service Enterprises, 830 CMR 64H.1.1.

tificate, please contact: Massachusetts Department of Revenue,

Customer Service Bureau, PO Box 7010, Boston, MA 02204, or

6. For further information about the use of resale certificates,

call (617) 887-MDOR or toll-free, in-state 1-800-392-6089.

see the regulation on Resale and Exempt Use Certificates, 830

CMR 64H.8.1.

Warning: Willful misuse of this certificate may result in criminal

tax evasion sanctions of up to one year in prison and $10,000

($50,000 for corporations) in fines.

This form is approved by the Commissioner of Revenue and may be reproduced.

40M 2/02 CRP0102

printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1