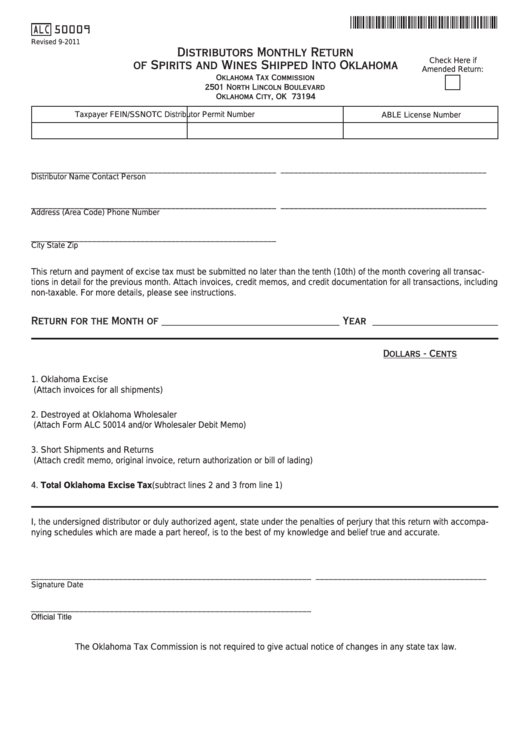

ALC 50009

Revised 9-2011

Distributors Monthly Return

of Spirits and Wines Shipped Into Oklahoma

Check Here if

Amended Return:

Oklahoma Tax Commission

2501 North Lincoln Boulevard

Oklahoma City, OK 73194

Taxpayer FEIN/SSN

OTC Distributor Permit Number

ABLE License Number

________________________________________________________

_______________________________________________

Distributor Name

Contact Person

________________________________________________________

_______________________________________________

Address

(Area Code) Phone Number

________________________________________________________

City

State

Zip

This return and payment of excise tax must be submitted no later than the tenth (10th) of the month covering all transac-

tions in detail for the previous month. Attach invoices, credit memos, and credit documentation for all transactions, including

non-taxable. For more details, please see instructions.

Return for the Month of __________________________________ Year ________________________

Dollars - Cents

1. Oklahoma Excise Tax........................................................................................ ______________________ . ________

(Attach invoices for all shipments)

2. Destroyed at Oklahoma Wholesaler ................................................................ ______________________ . ________

(Attach Form ALC 50014 and/or Wholesaler Debit Memo)

3. Short Shipments and Returns ........................................................................... ______________________ . ________

(Attach credit memo, original invoice, return authorization or bill of lading)

4. Total Oklahoma Excise Tax (subtract lines 2 and 3 from line 1) ..................... ______________________ . ________

I, the undersigned distributor or duly authorized agent, state under the penalties of perjury that this return with accompa-

nying schedules which are made a part hereof, is to the best of my knowledge and belief true and accurate.

________________________________________________________________

_______________________________________

Signature

Date

________________________________________________________________

Official Title

The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax law.

1

1 2

2