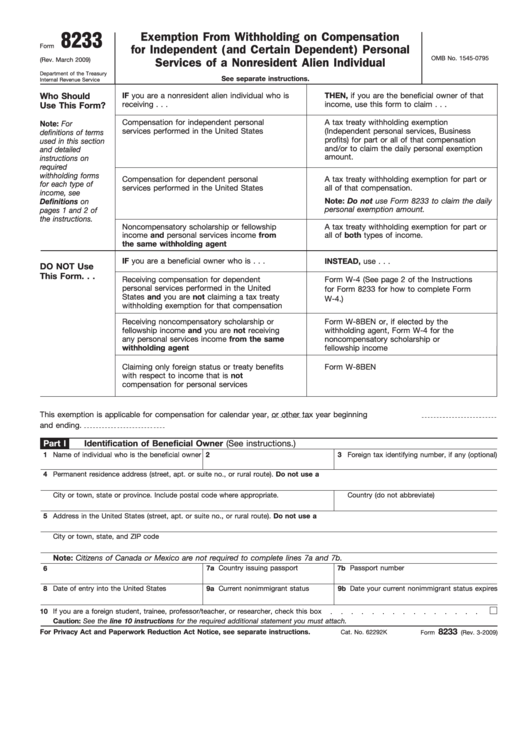

8233

Exemption From Withholding on Compensation

Form

for Independent (and Certain Dependent) Personal

OMB No. 1545-0795

(Rev. March 2009)

Services of a Nonresident Alien Individual

Department of the Treasury

See separate instructions.

Internal Revenue Service

Who Should

IF you are a nonresident alien individual who is

THEN, if you are the beneficial owner of that

receiving . . .

income, use this form to claim . . .

Use This Form?

Compensation for independent personal

A tax treaty withholding exemption

Note: For

services performed in the United States

(Independent personal services, Business

definitions of terms

profits) for part or all of that compensation

used in this section

and/or to claim the daily personal exemption

and detailed

amount.

instructions on

required

withholding forms

Compensation for dependent personal

A tax treaty withholding exemption for part or

for each type of

services performed in the United States

all of that compensation.

income, see

Note: Do not use Form 8233 to claim the daily

Definitions on

personal exemption amount.

pages 1 and 2 of

the instructions.

Noncompensatory scholarship or fellowship

A tax treaty withholding exemption for part or

income and personal services income from

all of both types of income.

the same withholding agent

IF you are a beneficial owner who is . . .

INSTEAD, use . . .

DO NOT Use

This Form. . .

Receiving compensation for dependent

Form W-4 (See page 2 of the Instructions

personal services performed in the United

for Form 8233 for how to complete Form

States and you are not claiming a tax treaty

W-4.)

withholding exemption for that compensation

Receiving noncompensatory scholarship or

Form W-8BEN or, if elected by the

fellowship income and you are not receiving

withholding agent, Form W-4 for the

any personal services income from the same

noncompensatory scholarship or

withholding agent

fellowship income

Claiming only foreign status or treaty benefits

Form W-8BEN

with respect to income that is not

compensation for personal services

This exemption is applicable for compensation for calendar year

, or other tax year beginning

and ending

.

Part I

Identification of Beneficial Owner (See instructions.)

1

Name of individual who is the beneficial owner

2

U.S. taxpayer identifying number

3

Foreign tax identifying number, if any (optional)

4

Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box.

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

5

Address in the United States (street, apt. or suite no., or rural route). Do not use a P.O. box.

City or town, state, and ZIP code

Note: Citizens of Canada or Mexico are not required to complete lines 7a and 7b.

7a

Country issuing passport

7b

Passport number

6

U.S. visa type

8

Date of entry into the United States

9a

Current nonimmigrant status

9b

Date your current nonimmigrant status expires

10

If you are a foreign student, trainee, professor/teacher, or researcher, check this box

Caution: See the line 10 instructions for the required additional statement you must attach.

8233

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 62292K

Form

(Rev. 3-2009)

1

1 2

2