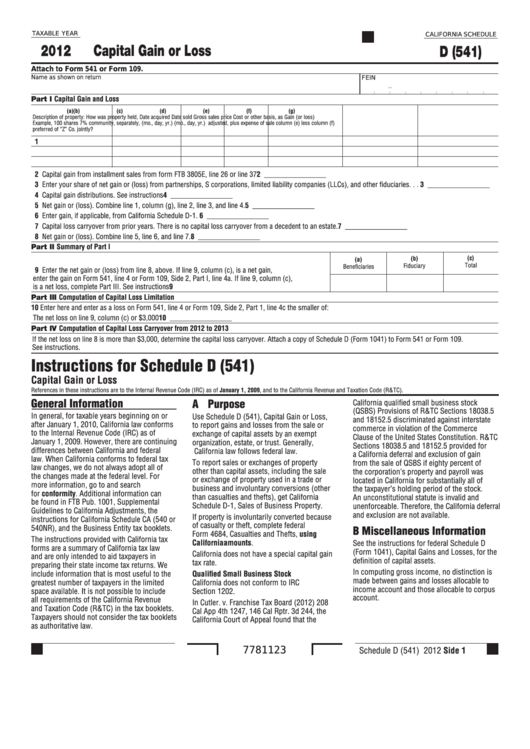

TAXABLE YEAR

CALIFORNIA SCHEDULE

Capital Gain or Loss

2012

D (541)

Attach to Form 541 or Form 109.

Name as shown on return

FEIN

-

Capital Gain and Loss

Part I

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property:

How was property held,

Date acquired

Date sold

Gross sales price

Cost or other basis, as

Gain (or loss)

Example, 100 shares 7%

community, separately,

(mo., day, yr.)

(mo., day, yr.)

adjusted, plus expense of sale

column (e) less column (f)

preferred of “Z” Co.

jointly?

1

2 Capital gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 _________________

3 Enter your share of net gain or (loss) from partnerships, S corporations, limited liability companies (LLCs), and other fiduciaries . . . 3 _________________

4 Capital gain distributions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 _________________

5 Net gain or (loss). Combine line 1, column (g), line 2, line 3, and line 4.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 _________________

6 Enter gain, if applicable, from California Schedule D-1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 _________________

7 Capital loss carryover from prior years. There is no capital loss carryover from a decedent to an estate. . . . . . . . . . . . . . . . . . . . . . . . 7 _________________

8 Net gain or (loss). Combine line 5, line 6, and line 7.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 _________________

Summary of Part I

Part II

(c)

(b)

(a)

Fiduciary

Total

Beneficiaries

9 Enter the net gain or (loss) from line 8, above. If line 9, column (c), is a net gain,

enter the gain on Form 541, line 4 or Form 109, Side 2, Part I, line 4a. If line 9, column (c),

is a net loss, complete Part III. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Part III Computation of Capital Loss Limitation

10 Enter here and enter as a loss on Form 541, line 4 or Form 109, Side 2, Part 1, line 4c the smaller of:

The net loss on line 9, column (c) or $3,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 _________________

Part IV Computation of Capital Loss Carryover from 2012 to 2013

If the net loss on line 8 is more than $3,000, determine the capital loss carryover. Attach a copy of Schedule D (Form 1041) to Form 541 or Form 109.

See instructions.

Instructions for Schedule D (541)

Capital Gain or Loss

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

A Purpose

California qualified small business stock

(QSBS) Provisions of R&TC Sections 18038.5

In general, for taxable years beginning on or

Use Schedule D (541), Capital Gain or Loss,

and 18152.5 discriminated against interstate

after January 1, 2010, California law conforms

to report gains and losses from the sale or

commerce in violation of the Commerce

to the Internal Revenue Code (IRC) as of

exchange of capital assets by an exempt

Clause of the United States Constitution. R&TC

January 1, 2009. However, there are continuing

organization, estate, or trust. Generally,

Sections 18038.5 and 18152.5 provided for

differences between California and federal

California law follows federal law.

a California deferral and exclusion of gain

law. When California conforms to federal tax

To report sales or exchanges of property

from the sale of QSBS if eighty percent of

law changes, we do not always adopt all of

other than capital assets, including the sale

the corporation’s property and payroll was

the changes made at the federal level. For

or exchange of property used in a trade or

located in California for substantially all of

more information, go to ftb.ca.gov and search

business and involuntary conversions (other

the taxpayer’s holding period of the stock.

for conformity. Additional information can

than casualties and thefts), get California

An unconstitutional statute is invalid and

be found in FTB Pub. 1001, Supplemental

Schedule D-1, Sales of Business Property.

unenforceable. Therefore, the California deferral

Guidelines to California Adjustments, the

and exclusion are not available.

If property is involuntarily converted because

instructions for California Schedule CA (540 or

of casualty or theft, complete federal

540NR), and the Business Entity tax booklets.

B Miscellaneous Information

Form 4684, Casualties and Thefts, using

The instructions provided with California tax

California amounts.

See the instructions for federal Schedule D

forms are a summary of California tax law

(Form 1041), Capital Gains and Losses, for the

California does not have a special capital gain

and are only intended to aid taxpayers in

definition of capital assets.

tax rate.

preparing their state income tax returns. We

In computing gross income, no distinction is

include information that is most useful to the

Qualified Small Business Stock

made between gains and losses allocable to

greatest number of taxpayers in the limited

California does not conform to IRC

income account and those allocable to corpus

space available. It is not possible to include

Section 1202.

account.

all requirements of the California Revenue

In Cutler. v. Franchise Tax Board (2012) 208

and Taxation Code (R&TC) in the tax booklets.

Cal App 4th 1247, 146 Cal Rptr. 3d 244, the

Taxpayers should not consider the tax booklets

California Court of Appeal found that the

as authoritative law.

Schedule D (541) 2012 Side 1

7781123

1

1 2

2