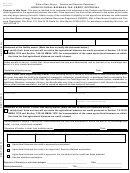

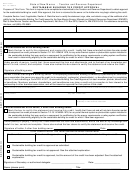

Form Rpd-41327 - Sustainable Building Tax Credit Approval Page 2

ADVERTISEMENT

State of New Mexico - Taxation and Revenue Department

RPD-41327

Rev. 10/18/2013

SUSTAINABLE BUILDING TAX CREDIT APPROVAL

Page 1 of 4

ABOUT THIS CREDIT

building for purposes of the sustainable building tax credit.

The purpose of the Sustainable Building Tax Credit is to

To apply for a certificate of eligibility, contact the Energy Efficiency

encourage the construction of sustainable buildings and the

and Green Building Administrator at (505) 476-3254, or write to

renovation of existing buildings into sustainable buildings. For

Energy, Minerals and Natural Resources Department, 1220 So.

tax years ending on or before December 31, 2016, the tax credit

St. Francis Dr., Santa Fe, NM 87505.

is available for the construction in New Mexico of a sustainable

building, for the renovation of an existing building in New Mexico

Annual Limits Established for Approving Applications

into a sustainable building, or for the permanent installation of

Effective January 1, 2014*, EMNRD cannot issue a certificate

manufactured housing in New Mexico, regardless of where the

of eligibility if the total amount of sustainable building tax credits

housing is manufactured, that is a sustainable building.

issued in a calendar year exceeds an aggregate amount of

$1,000,000 with respect to sustainable commercial buildings and

The credit is available for residential and commercial buildings,

an aggregate amount of $4,000,000 with respect to sustainable

after the construction, installation, or renovation of the sustainable

residential buildings, provided that no more than $1,250,000 of

building is complete. To qualify for the sustainable building

the aggregate amount with respect to sustainable residential

tax credit, the building must have achieved a silver or higher

buildings shall be for manufactured housing. Applications are

certification level in the Leadership in Energy and Environmental

considered in the order received.

Design (LEED) green building rating system or the Build Green

NM rating system.

If for any tax year, EMNRD determines that the applications

for sustainable building tax credits with respect to sustainable

Tax Credit For Sustainable Commercial Buildings

residential buildings for that taxable year exceed the aggregate

The credit calculation is based on the certification level the

limit above, EMNRD may issue certificates of eligibility under

building achieved in the LEED green building rating system and

the aggregate annual limit for sustainable commercial buildings

the amount of qualified occupied square footage in the building.

to owners of sustainable residential buildings that meet the

See the commercial building rate chart on the last page of these

requirements of EMNRD and of the sustainable building tax

instructions.

credit, provided that applications for sustainable building credits

for other sustainable commercial buildings total less than the

Tax Credit For Sustainable Residential Buildings

full amount allocated for tax credits for sustainable commercial

The credit calculation is based on the Build Green NM rating

buildings.

system certification level and the amount of qualified occupied

square footage in the building. See the residential building rate

*Prior to January 1, 2014, the aggregate limitations for a calendar

chart on the last page of these instructions.

year were $5,000,000 with respect to sustainable commercial

buildings and $5,000,000 with respect to sustainable residential

buildings.

To qualify for the sustainable building tax credit, the certification

level for a sustainable residential building must be awarded on

Tax Credit Forms

or after January 1, 2007, and the building owner must be:

Before you can claim a credit, the Taxation and Revenue

(1) the owner of the sustainable residential building at the time

Department must give you approval to receive the credit. The

the certification level for the building in the LEED green building

following list shows all the forms for sustainable building tax

rating system or the Build Green NM rating system is awarded, or

credits:

(2) the subsequent purchaser of a sustainable residential building

• RPD-41327, Sustainable Building Tax Credit Approval

with respect to which no tax credit has been previously claimed.

• RPD-41342, Notice of Transfer of Sustainable Building Tax

Obtaining the Certificate of Eligibility

Credit

• RPD-41329, Sustainable Building Tax Credit Claim Form,

The owner of the building must first obtain a certificate of eligibility

which includes Schedule A, Worksheet To Compute the Total

for the sustainable building tax credit from EMNRD after the

Excess Credit Available For Carryforward and Schedule B,

construction, installation, or renovation of sustainable building is

complete. EMNRD determines whether the building owner meets

Worksheet to Compute Amount of Credit to Apply in Tax Year

the requirements as a sustainable residential or sustainable

Requesting the Tax Credit Approval from the Taxation and

commercial building and verifies the certification level awarded

Revenue Department

for the building.

After EMNRD issues the certificate of eligibility, the owner of the

building must promptly complete Form RPD-41327, Sustainable

If approved, EMNRD issues the building owner a certificate of

Building Tax Credit Approval, and submit it to the Taxation and

eligibility. The certificate includes the rating system certification

Revenue Department (TRD) with a copy of the certificate of

level awarded to the building, the amount of qualified occupied

eligibility. If all requirements have been complied with, TRD

square footage in the building, and a calculation of the maximum

approves the credit and returns the approved form to the owner

amount of sustainable building tax credit for which the building

or holder. The sustainable building tax credit allowed an eligible

owner is eligible.

owner of a qualifying sustainable building may be claimed against

the owner’s personal or corporate income tax liability or may be

NOTE: Buildings owned by state or local governments, public

sold, exchanged, or otherwise transferred to another taxpayer.

school districts, or tribal agencies do not qualify as a sustainable

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5