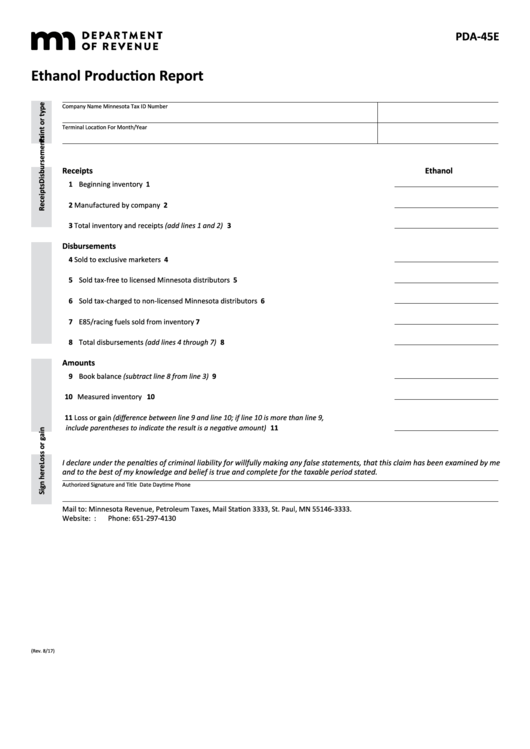

PDA-45E

Ethanol Production Report

Company Name

Minnesota Tax ID Number

Terminal Location

For Month/Year

Receipts

Ethanol

1 Beginning inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Manufactured by company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total inventory and receipts (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Disbursements

4 Sold to exclusive marketers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Sold tax-free to licensed Minnesota distributors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Sold tax-charged to non-licensed Minnesota distributors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 E85/racing fuels sold from inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Total disbursements (add lines 4 through 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Amounts

9 Book balance (subtract line 8 from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Measured inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Loss or gain (difference between line 9 and line 10; if line 10 is more than line 9,

include parentheses to indicate the result is a negative amount) . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

I declare under the penalties of criminal liability for willfully making any false statements, that this claim has been examined by me

and to the best of my knowledge and belief is true and complete for the taxable period stated.

Authorized Signature and Title

Date

Daytime Phone

Mail to: Minnesota Revenue, Petroleum Taxes, Mail Station 3333, St. Paul, MN 55146-3333.

Website:

Email: Petroleum.Tax@state.mn.us

Phone: 651-297-4130

(Rev . 8/17)

1

1