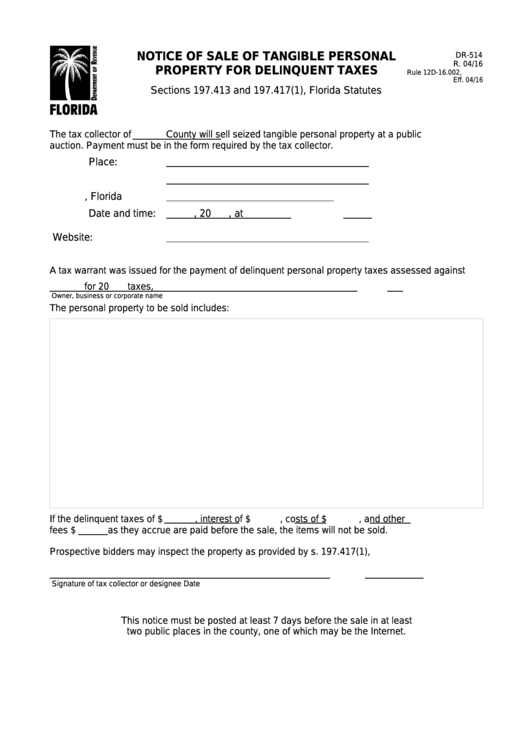

Form Dr-514 - Notice Of Sale Of Tangible Personal Property For Delinquent Taxes

ADVERTISEMENT

NOTICE OF SALE OF TANGIBLE PERSONAL

DR-514

R. 04/16

PROPERTY FOR DELINQUENT TAXES

Rule 12D-16.002, F.A.C.

Eff. 04/16

Sections 197.413 and 197.417(1), Florida Statutes

The tax collector of

County will sell seized tangible personal property at a public

auction. Payment must be in the form required by the tax collector.

Place:

, Florida

Date and time:

, 20

, at

Website:

A tax warrant was issued for the payment of delinquent personal property taxes assessed against

for 20

taxes,

Owner, business or corporate name

The personal property to be sold includes:

If the delinquent taxes of $

, interest of $

, costs of $

, and other

fees $

as they accrue are paid before the sale, the items will not be sold.

Prospective bidders may inspect the property as provided by s. 197.417(1), F.S.

Signature of tax collector or designee

Date

This notice must be posted at least 7 days before the sale in at least

two public places in the county, one of which may be the Internet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1