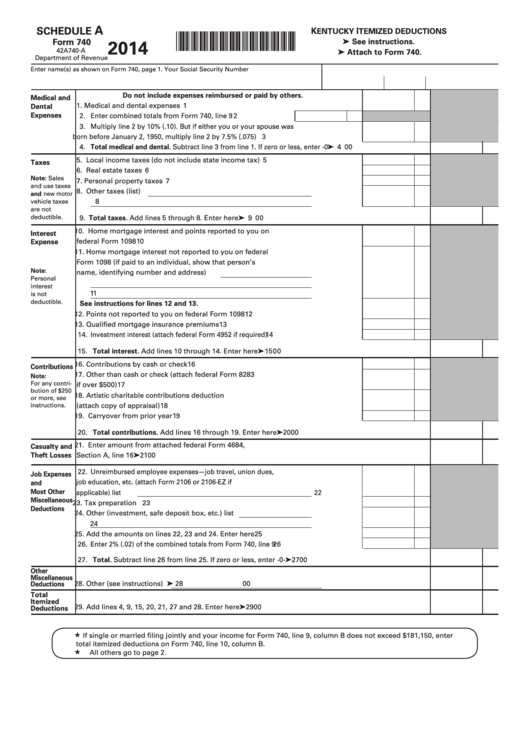

A

SCHEDULE

K

I

ENTUCKY

TEMIZED DEDUCTIONS

*1400030012*

Form 740

➤ See instructions.

2014

42A740-A

➤ Attach to Form 740.

Department of Revenue

Enter name(s) as shown on Form 740, page 1.

Your Social Security Number

Do not include expenses reimbursed or paid by others.

Medical and

1. Medical and dental expenses ...................................................................................... 1

Dental

Expenses

2. Enter combined totals from Form 740, line 9 ........................... 2

3. Multiply line 2 by 10% (.10). But if either you or your spouse was

born before January 2, 1950, multiply line 2 by 7.5% (.075) instead.............................. 3

4. Total medical and dental. Subtract line 3 from line 1. If zero or less, enter -0- .......................................... ➤ 4

00

5. Local income taxes (do not include state income tax) .............................................. 5

Taxes

6. Real estate taxes ........................................................................................................... 6

Note: Sales

7. Personal property taxes ............................................................................................... 7

and use taxes

8. Other taxes (list)

and new motor

.................... 8

vehicle taxes

are not

deductible.

9. Total taxes. Add lines 5 through 8. Enter here ......................................................................................... ➤ 9

00

10. Home mortgage interest and points reported to you on

Interest

federal Form 1098 ......................................................................................................... 10

Expense

11. Home mortgage interest not reported to you on federal

Form 1098 (if paid to an individual, show that person’s

Note:

name, identifying number and address)

Personal

interest

.................... 11

is not

deductible.

See instructions for lines 12 and 13.

12. Points not reported to you on federal Form 1098 ...................................................... 12

13. Qualified mortgage insurance premiums .................................................................. 13

14. Investment interest (attach federal Form 4952 if required) ............................................ 14

15. Total interest. Add lines 10 through 14. Enter here ................................................................................. ➤ 15

00

16. Contributions by cash or check ................................................................................... 16

Contributions

17. Other than cash or check (attach federal Form 8283

Note:

For any contri-

if over $500) .................................................................................................................. 17

bution of $250

18. Artistic charitable contributions deduction

or more, see

(attach copy of appraisal) ............................................................................................ 18

instructions.

19. Carryover from prior year ............................................................................................ 19

20. Total contributions. Add lines 16 through 19. Enter here ....................................................................... ➤ 20

00

21. Enter amount from attached federal Form 4684,

Casualty and

Theft Losses

Section A, line 16 ........................................................................................................................................ ➤ 21

00

22. Unreimbursed employee expenses—job travel, union dues,

Job Expenses

job education, etc. (attach Form 2106 or 2106-EZ if

and

Most Other

applicable) list

..................... 22

Miscellaneous

23. Tax preparation fees..................................................................................................... 23

Deductions

24. Other (investment, safe deposit box, etc.) list

.................... 24

25. Add the amounts on lines 22, 23 and 24. Enter here ................................................ 25

26. Enter 2% (.02) of the combined totals from Form 740, line 9 ........................................ 26

27. Total. Subtract line 26 from line 25. If zero or less, enter -0- .................................................................. ➤ 27

00

Other

Miscellaneous

Deductions

28. Other (see instructions)

.......................................... ➤ 2 8

00

Total

Itemized

29. Add lines 4, 9, 15, 20, 21, 27 and 28. Enter here ...................................................................................... ➤ 29

00

Deductions

If single or married filing jointly and your income for Form 740, line 9, column B does not exceed $181,150, enter

total itemized deductions on Form 740, line 10, column B.

All others go to page 2.

1

1 2

2